Advertisement|Remove ads.

Mammoth Energy Services Stock Rockets 15% Pre-Market Despite Mixed Q4 Performance: Retail Optimism’s Intact

Mammoth Energy Services, Inc. (TUSK) shares rose nearly 15% in Friday’s pre-market session after the company reported a marginal uptick in its fourth-quarter revenue, but losses widened compared to last year.

The company reported a total revenue $53.2 million for the fourth quarter (Q4) compared to $52.8 million for the same quarter of 2023 and a Wall Street estimate of $39.5 million, according to Stocktwits data.

The quarter saw net loss widen to $15.5 million, or $0.32 per diluted share, compared to a loss of $0.12 per diluted share in the same quarter last year and a Street estimate of $0.14 loss.

The company’s infrastructure services division revenue stood at $27.9 million compared to $27.2 million last year. Its Well Completion Services division contributed revenue of $15.8 million for the fourth quarter, in line with the year-ago period.

Natural sand proppant services division contributed revenue of $5.1 million compared to $4.5 million for the same quarter of 2023.

CEO Phil Lancaster said that despite typical seasonality and budget exhaustion, the company experienced increased utilization, which helped drive sequential improvement.

“Although we expect 2025 activity to be relatively steady, we have line of sight for potential upside performance compared to 2024 driven by incremental natural gas-related demand, which may further contribute to improved financial results. While these tailwinds may not materialize until later this year, we are seeing elevated activity from our customers that will lead to additional utilization improvements in the first quarter,” he said.

As of March 5, 2025, Mammoth declared an unrestricted cash on hand of $64.8 million, no outstanding borrowings under its revolving credit facility, and a borrowing base of $33.7 million.

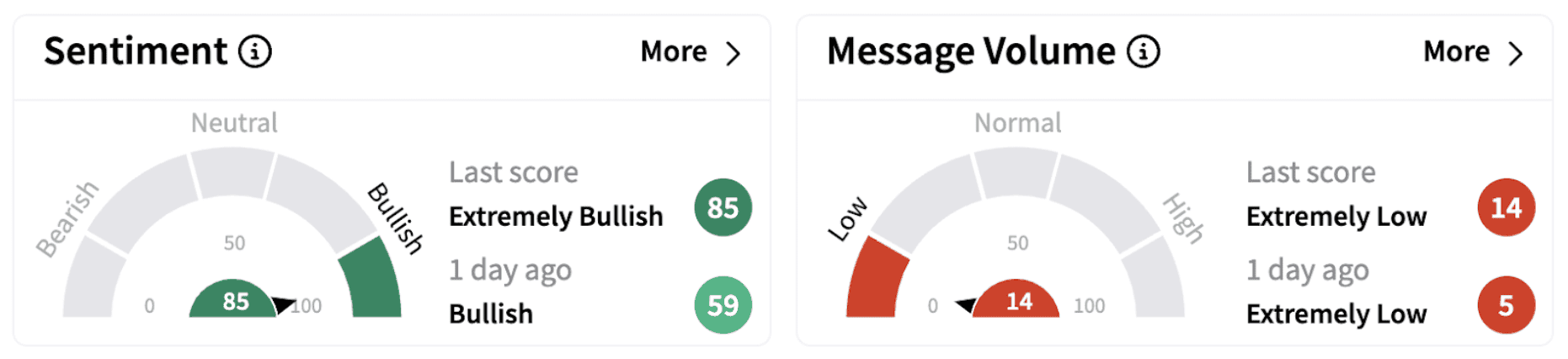

On Stocktwits, retail sentiment climbed into the ‘extremely bullish’ territory (85/100) from ‘bullish’ a day ago.

TUSK shares have lost over 27% in 2025 and are down over 40% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1230125578_jpg_85f30da0d4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1233729079_jpg_0ced7540cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)