Advertisement|Remove ads.

BLNK Stock Shot Up 7% Today: What’s Driving The Rally?

- Blink plans to move to a contract manufacturing model for its EV charging hardware.

- The transition is expected to be completed by early 2026.

- Blink Charging will retain complete ownership of its intellectual property.

Blink Charging Co. (BLNK) on Wednesday announced a major change in its business strategy, revealing plans to move to a contract manufacturing model for its electric vehicle (EV) charging equipment.

The transition aims to boost growth under the company’s broader ‘BlinkForward’ initiative.

Strategic Overhaul To Enhance Profit

The company expects to reduce costs, enhance flexibility, and reallocate resources toward innovation and customer-focused solutions by outsourcing the manufacturing of its charging hardware.

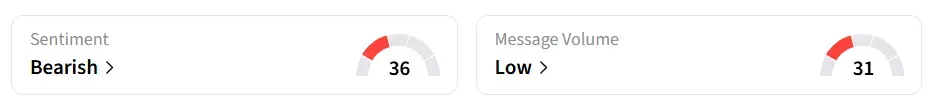

Following the announcement, Blink Charging’s stock traded over 8%higher on Wednesday afternoon. However, on Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘low’ message volume levels.

Blink’s main products and services include its EV charging network, charging hardware, and related charging solutions. The Blink Network runs on custom cloud-based software that manages, monitors, and collects data from all connected charging stations.

The company’s strategy involves partnerships with multiple manufacturers in both the U.S. and India to diversify its supply chain.

Transition Timeline

The company stated that the transition is already underway and is expected to be completed by early 2026.

Despite the move to contract production, Blink emphasized that it will retain complete ownership of its intellectual property and remain in charge of all aspects of design, quality assurance, and technology development.

“This move sharpens our focus and scales our impact.”

-Mike Battaglia, President, CEO, Blink Charging

In October, the company launched Shasta chargers, a line of Level 2 (L2) EV chargers tailored specifically for multifamily and fleet applications.

Blink Charging is scheduled to report its third-quarter earnings on Thursday. Analysts expect a Q3 revenue of $30 million and a loss per share (EPS) of $0.17, according to Fiscal AI data.

BLNK stock has gained over 14% in 2025 and lost over 25% in the past 12 months.

Also See: Michael Burry’s Bets Against Palantir, Nvidia Likely Losing Money, Says Market Veteran: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)