Advertisement|Remove ads.

Boeing, GE May Need To Redesign Engine Seal On 777X Jetliner: Report

- The issue was discovered at an inspection recently, and the companies are evaluating the next steps, as per the report.

- While it may be necessary to redesign and retrofit the seals in future maintenance overhauls, it is not expected to further delay the 777X jetliners, as per the report.

- GE Aerospace, which makes the engines, reportedly told Bloomberg that it was still evaluating whether any corrective action would be required to fix the deal.

Boeing Co. (BA) and General Electric Co. (GE) reportedly found a possible durability problem on the 777X aircraft.

According to a report from Bloomberg news, which cited people familiar with the matter, a seal on the engine of the planemaker’s aircraft may have potential durability issues.

The issue was discovered at an inspection recently, and the companies are evaluating the next steps, as per the report.

While it may be necessary to redesign and retrofit the seals in future maintenance overhauls, it is not expected to further delay the 777X jetliners, which are already delayed, the report said.

Shares of BA were down 0.3% at the time of writing, while shares of GE gained 0.63%.

Path Forward

GE Aerospace, which makes the engines, reportedly told Bloomberg that it was still evaluating whether any corrective action would be required to fix the deal.

The company said in an email to Bloomberg that it has an on-wing inspection program that will assist Boeing. Simultaneously, the engine-maker said it is analyzing the issue and will come up with corrective action in line with its safety and quality systems, if applicable.

Earlier, the largest customer for the 777X, Emirates, had said that it will not tolerate any teething issues with the jetliner.

The first Boeing 777X jetliners were initially slated for delivery in 2020. Now, the schedule has been pushed to 2027, seven years behind the original timeline. It also cost the company over $5 billion in late delivery penalties in October 2025.

The latest issue with the seal comes even as Boeing is under severe scrutiny from customers, investors, and lawmakers.

How Did Stocktwits Users React?

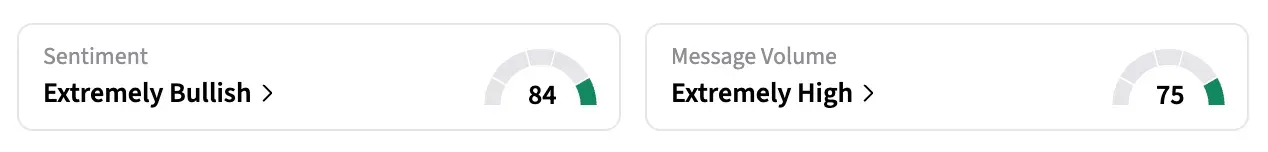

On Stocktwits, retail sentiment around BA shares was in the ‘extremely bullish’ territory over the past 24 hours, amid ‘extremely high’ message volumes.

Shares of BA have gained over 32% in the past year.

Meanwhile, shares of GE have climbed over 51% in the same period.

Also Read: SMCI Stock Rises Ahead Of Q2 Earnings — What Does The Street Expect?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)