Advertisement|Remove ads.

Boeing Stock Draws Attention After Posting Largest Annual Loss Since 2020: Retail Turns More Bearish

Boeing (BA) shares were in the spotlight on Tuesday after the company reported a wider-than-expected loss during the fourth quarter and registered its highest annual loss since 2020.

During the fourth quarter (Q4), the airplane manufacturer reported an earnings loss of $5.90 per share, worse than an estimated loss of $3.78 per share, according to FinChat. Its net loss for the quarter stood at $3.86 billion.

The dip in financials primarily reflected previously announced impacts of the IAM work stoppage and agreement, charges for certain defense programs, and costs associated with workforce reductions announced last year.

Revenue declined 31% year-over-year (YoY) to $15.24 billion during the quarter compared to a Wall Street estimate of $15.2 billion.

Commercial Airplanes’ fourth-quarter revenue fell 55% to $4.8 billion, while Defense, Space & Security revenue fell 20% to $5.4 billion. Global Services’ revenue rose 6% to $5.1 billion during the quarter.

For the full year 2024, Boeing reported a net loss of $11.83 billion, marking its largest annual loss since 2020, according to a CNBC report. The company faced multiple headwinds last year, including a midair door panel blowout and a weeks-long strike by machinists.

CEO Kelly Ortberg said that the company made progress in key areas to stabilize its operations during the quarter and continued to strengthen essential aspects of safety and quality plans.

"My team and I are focused on making the fundamental changes needed to fully recover our company's performance and restore trust with our customers, employees, suppliers, investors, regulators, and all others who are counting on us,” he said,

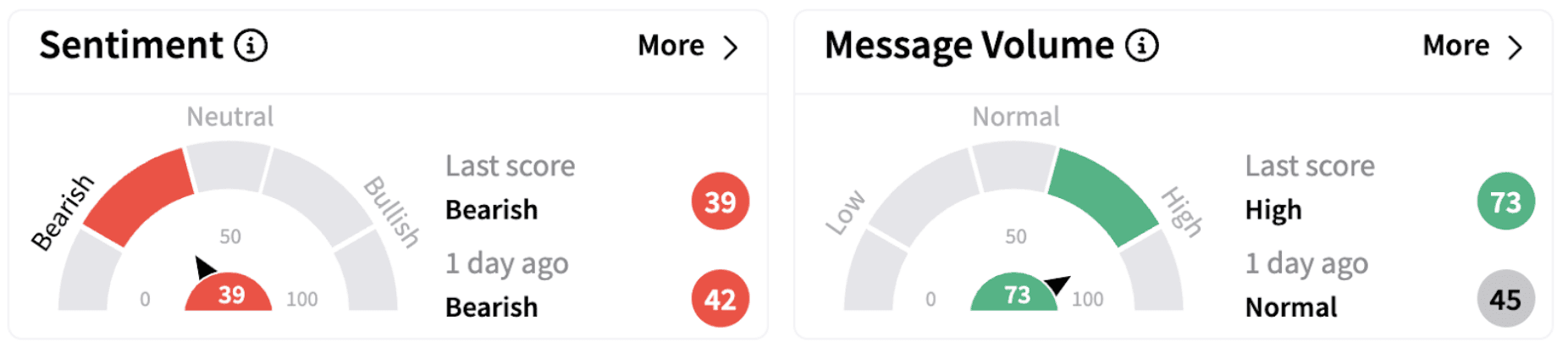

On Stocktwits, retail sentiment continued to trend in the ‘bearish’ territory (39/100) accompanied by high retail chatter.

Retail chatter, however, indicated a mixed take on the stock.

Boeing stock has gained nearly 2% this year but has lost over 14% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)