Advertisement|Remove ads.

Boeing Shares Slip After Q3 Losses As CEO Targets Recovery: Retail Sentiment Unfazed

Shares of Boeing Inc. ($BA) fell 1% pre-market Wednesday after the aerospace giant reported significant losses for its third quarter.

However, the massive loss per share of $10.44 and a 1.6% dip in revenue year-on-year (YoY) at $17.8 billion, was as expected amid Boeing’s ongoing financial struggles, union strike, and client concerns.

The company has a backlog of $511 billion, including over 5,400 planes.

“It will take time to return Boeing to its former legacy but, with the right focus and culture, we can be an iconic company and aerospace leader once again,” stated Boeing CEO Kelly Ortberg In a message to employees regarding third-quarter results.

These results represent the first quarterly earnings under Ortberg's leadership since he took over in August.

The big losses come at a turbulent period for the planemaker. Its stock is down 36% since the start of the year.

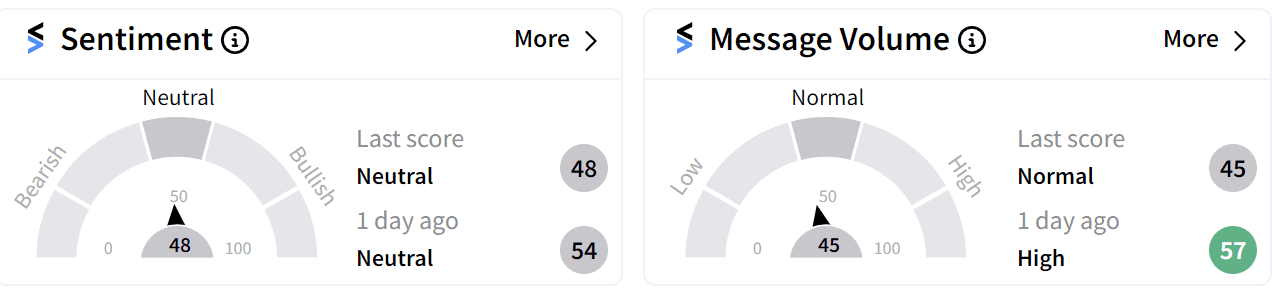

Retail sentiment appears largely unaffected by Boeing’s third-quarter earnings, holding steady in the ‘neutral’ (48/100) territory, unchanged from the previous day as users wait for the union vote to take place later on Wednesday.

Boeing’s workers have been on strike since Sept. 13, which has halted production at its factories. The airplane manufacturer reached a tentative agreement with the mechanists union late last week. The proposal needs a majority vote to come through.

Bank of America (BofA) analysts expressed optimism about union members voting to end the strike, noting that acting Labor Secretary Julie Su mediated the negotiations.

Earlier this month, Boeing announced plans to lay off about 17,000 employees as well as further delays to the 777X program. Tim Clark, president of Emirates and one of Boeing’s largest customers, criticized Boeing, stating they would need to have a "serious conversation."

Following the layoff announcement, Boeing disclosed in regulatory filings that it had secured a $10 billion credit agreement with four major banks and may sell up to $25 billion in securities.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)