Advertisement|Remove ads.

Boeing Stock Surges 6% To Reclaim 200-SMA After CFO Brian West Provides Upbeat Outlook: Retail’s Elated

Shares of Boeing Co (BA) rose by over 6% on Wednesday after CFO Brian West presented an upbeat outlook for the airplane manufacturer at the Bank of America investor conference.

According to a CNBC report, West indicated that Boeing’s cash burn is easing in the current quarter, and its factories are improving as the company begins to emerge from its several manufacturing and safety crises.

“We think we’re off to a good start for the year,” West said, according to the report. According to the CFO, the cash burn improvement could be in the “hundreds of millions” of dollars.

Meanwhile, according to a Reuters report, West expressed concerns about how President Donald Trump's tariffs could affect the availability of parts from its suppliers but said the planemaker has a large enough inventory for now.

Earlier this week, Wells Fargo analyst Matthew Akers raised the firm's price target on Boeing to $113 from $103 while keeping an ‘Underweight’ rating on the shares.

Last week, Citi reiterated a ‘Buy’ rating with a $210 price target. Citi said the stock is pricing in less than 1% free cash flow growth in perpetuity. The brokerage also indicated a 3% growth rate is achievable, given the expected growth in the commercial aerospace and defense end markets.

Boeing recently disclosed that its February deliveries surged 63% from last year to 44. The figure includes 31 of the company’s best-selling 737 MAX planes. The month also witnessed 13 orders and eight cancellations.

The latest figure brings Boeing’s 2025 total to 89, up from 54 in the same period a year ago.

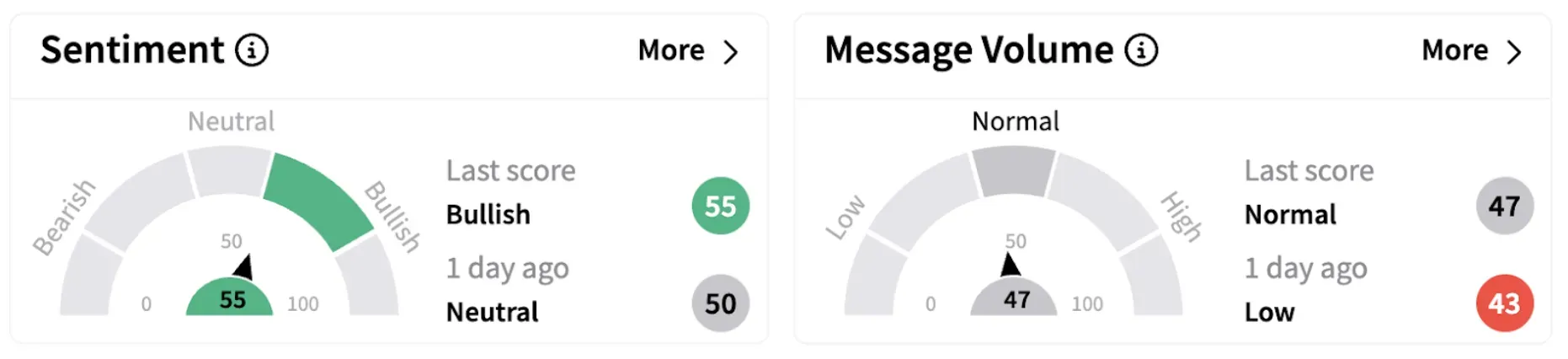

Meanwhile, on Stocktwits, retail sentiment climbed into ‘bullish’ territory (55/100) from ‘neutral’ a day ago. Message volume also rose to ‘normal’ levels.

One user said they expect the stock to hit the $188 mark.

Another user noted that the stock has reclaimed the 200-day simple moving average.

Boeing stock remains flat year to date and has been down over 5% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)