Advertisement|Remove ads.

Boeing Stock Takes Its Heaviest Hit In A Month: Analyst Calls Selloff Overblown

Boeing (BA) stock slipped 4.4% on Tuesday, its worst session since the Air India crash in mid-June, despite the planemaker posting a smaller-than-expected quarterly loss.

The aerospace giant reported a loss of $1.24 per share for the second quarter, which is lower than the estimated loss of $1.40 per share, according to Stocktwits data. Its revenue stood at $22.75 billion, higher than the expected $22.12 billion.

However, in a relief to several Wall Street analysts, the company managed to keep the cash outflow during Q2 to just $200 million, far lower than the $1.8 billion that analysts reportedly expected.

Barclays raised the price target of Boeing stock to $255 from $210. The new price target implied an upside of 12.8% compared to the stock’s previous closing price.

The brokerage said that the price action on Tuesday was surprising, and there was nothing in the results that would warrant it, according to TheFly. Barclays also noted that the planemaker posted a “clean” free cash flow beat, without any unusual working capital boost other than the previously known higher aircraft deliveries.

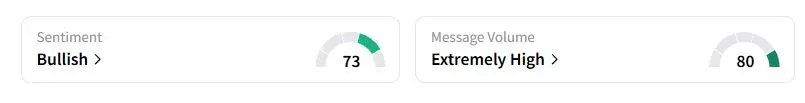

Retail sentiment on Stocktwits on Boeing was in the ‘extremely bullish’ territory compared with ‘bullish’ a day ago, while retail chatter was ‘extremely high.’

During the first half of the year, Boeing's commercial aircraft deliveries have increased to 280, compared with 175 for the same period a year earlier. Aircraft deliveries are closely watched on Wall Street as the planemaker receives the bulk of its payment after handing over the planes to customers.

The company’s production of its best-selling 737 Max jet is also stabilizing at 38 per month, a limit set by the U.S. Federal Aviation Administration following concerns over quality control after a mid-air incident involving a Boeing aircraft operated by Alaska Airlines. “We expect to be in a position to request approval from the FAA in the coming months to increase to 42 aircraft per month,” CEO Kelly Ortberg said in a call with analysts.

However, the company is not out of the woods yet. Ortberg said that the certification of the Max-7 and Max-10 variants, the smallest and largest types of aircraft in the 737 family, will be delayed until next year, as Boeing continues to work on resolving icing issues in the engine.

On the production side, over 3,200 Boeing workers at its defense aircraft-making unit could go on strike after Sunday unless the company reaches a deal. “We will manage through this,” Ortberg said.

Boeing stock has risen nearly 27% this year.

Also See: Hawaiian Electric Secures Facilities As Tsunami Warning Follows Massive Quake In Russia’s Far East

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_solaredge_technologies_resized_56b964ed87.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240244443_jpg_6b67e8f303.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)