Advertisement|Remove ads.

BofA Lowers Crocs Price Target, But Keeps 'Buy' Rating On Potential Upside In Foreign Market

Footwear company Crocs (CROX) is facing sales pressure in the U.S. for its wholesale channels but is gaining momentum in terms of direct-to-consumer sales and in foreign markets, according to a note from Bank of America.

The brokerage reiterated its 'Buy' rating on the company's shares, while lowering its price target by $5 to $135. The current target indicates a 33% upside from current levels.

"There are a lot of moving parts but the key driver to our lower forecast is lower wholesale sales (both brands); this is partly offset by improving (foreign exchange) rates and a slightly better (gross margin) forecast," BofA said in the note.

It added that markets such as Western Europe, China and India will continue to be the key growth drivers, as Crocs has less than 2% market share in all three. "In India, we think a growing middle class and an improvement in the supply situation should now allow Crocs to meet demand."

BofA said the impact of tariffs on Vietnam, which produces a significant portion of Crocs footwear, is currently "manageable."

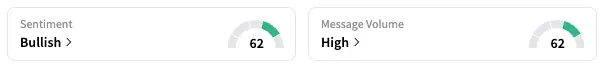

On Stocktwits, the retail sentiment for the company shifted to 'bullish' from 'extremely bullish' the previous day. Crocs shares are down 7.5% year-to-date.

Posts on the platform suggested that a few users had started a position on CROX in recent days. One user said, "$CROX is probably the best value in the entire market."

Crocs' revenue and profit for the last quarter were above expectations, but the company withdrew its full-year 2025 outlook in May.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)