Advertisement|Remove ads.

BP Stock In Spotlight After Report Says Elliott To Ramp Up Pressure, Retail Chatter Stays High

BP Plc (BP) garnered retail attention on Thursday after Bloomberg reported that activist investor Elliott Investment Management was ramping up pressure on the company after its new strategy fell short of expectations.

Bloomberg reported, citing people with knowledge of the matter, that Elliott viewed BP CEO Murray Auchincloss’s turnaround plan as lacking urgency and ambition.

The report added that Auchincloss and Chairman Helge Lund, who was one of the main backers of the company’s now-criticized net-zero strategy, could come under particular pressure.

After years of lagging behind peers, Shell and Exxon, with regard to share performance, the British oil major announced earlier this week that it would raise its investment in oil and gas to $10 billion per year and lift production to 2.3 million to 2.5 million barrels of oil equivalent per day (boe/d) by 2030.

The company also said it aims to reduce its annual capital expenditures to between $13 billion and $15 billion by 2027 and it is targeting cost reductions of $4 billion to $5 billion by the end of that year.

BP is also looking to gain $20 billion in divestment proceeds by 2027, through a strategic review of its lubricants business, Castrol, and by bringing a partner into its solar energy unit, Lightsource bp.

Piper Sandler analyst Ryan Todd raised the price target on BP to $35 from $32, according to The Fly.

The brokerage sees most of the strategic changes and targets as being in line with expectations, with the medium-term outlook appearing more favorable. However, they expect the market to stay cautious about the updated targets until proven otherwise.

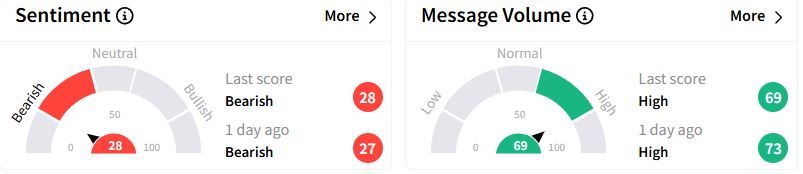

Retail Sentiment on Stocktwits remained in the ‘bearish’(28/100) zone, while retail chatter was ‘high.’

Over the past week, retail chatter on BP has grown by 325%.

BP stock has fallen 6.8% over the past 12 months.

Also See: Redfin Corp Stock Falls After Q4 Loss Widens, Retail Wants To Buy The Dip

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)