Advertisement|Remove ads.

Redfin Corp Stock Falls After Q4 Loss Widens, Retail Wants To Buy The Dip

Redfin Corp (RDFN) stock fell 10.9% in after-market trading on Thursday after it posted a wider fourth-quarter net loss.

The real estate brokerage firm reported a net loss of $36.7 million, or $0.29 per share, for the fourth quarter, compared to a loss of $23.1 million, or $0.20 per share in the year-ago quarters.

Redfin said its earnings were hurt by higher-than-expected one-time transition costs associated with Redfin Next, which pays its agents entirely on commissions.

The company’s fourth-quarter revenue rose 12% to $244.3 million compared to the year-ago quarter. Analysts, on average, were expecting to post $242.5 million in revenue.

Redfin said its lead-agent census has increased from an average of 1,757 in the third quarter to more than 2,200 currently.

For the first quarter, the company projected revenue between $214 million and $225 million, while analysts, on average, expect it to post $243.7 million in revenue, according to FinChat data.

Redfin also forecasted first quarter total net loss to be between $94 million and $83 million.

“Demand increased after the November election, but interest rates seem likely to remain

high, making it hard for the homebuyers turning out now to afford a home,” CEO Glenn Kelman said.

The company said its rental partnership with Zillow, signed in February, would double the number of high-quality apartment listings on its websites, enabling it to compete better for user traffic.

Redfin said that the $100-million payment it received from the partnership would bolster its balance sheet, and partly fund a 38% increase in 2025 advertising.

“Due to the increased profits from this rentals partnership, and a January layoff of senior Redfin personnel, we can invest more in growth and still earn a significant adjusted-EBITDA profit in 2025,” Kelman added.

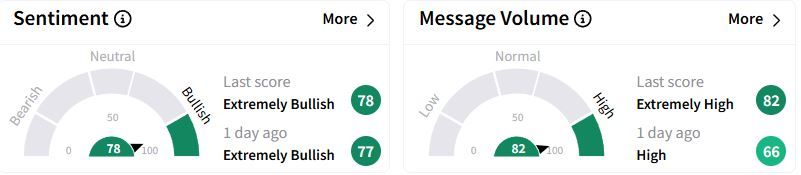

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ (78/100) territory while retail chatter jumped to ‘extremely high.’

One retail user desired to buy 3,000 shares of the company if it dipped further.

Over the past year, Redfin stock has gained 10.4%.

Also See: Archer Aviation Stock Sinks On Wider Q4 Loss, But Retail Confidence Stays Airborne

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)