Advertisement|Remove ads.

BP To Lift Fossil Fuel Production, Curb Energy Transition Spending: Retail Has Mixed Feelings

BP’s U.S. shares (BP) closed 1.7% lower on Wednesday after the company said it would raise its oil and gas production and reduce spending on energy transition.

The British oil major said it would raise its investment in oil and gas to $10 billion per year and lift production to 2.3 million to 2.5 million barrels of oil equivalent per day (boe/d) by 2030.

It would also lower investment in its energy transition businesses to between $1.5 billion and $2 billion annually, which signifies a cut of over $5 billion from its prior forecast.

The company also said it aims to reduce its annual capital expenditures to between $13 billion and $15 billion by 2027 and it is targeting cost reductions of $4 billion to $5 billion by the end of that year.

It said it would also aim for $20 billion in divestments by 2027 through a strategic review of its lubricants business, Castrol, and by bringing a partner into its solar energy unit, Lightsource bp.

The company also set a goal of reducing net debt to $14 billion to $18 billion by 2027 compared with close to $23 billion in debt last year.

Over the past few years, BP’s shares have lagged behind rivals such as Exxon, Chevron, and Shell. Under former CEO Bernard Looney, BP invested heavily in renewable energy instead of fossil fuel, based on a miscalculated bet that oil demand had already peaked by 2020.

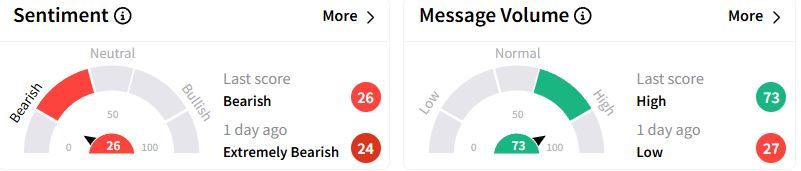

Retail sentiment on Stocktwits moved to bearish (26/100) territory from ‘extremely bearish’(24/100) a day ago, while retail chatter was ‘high.’

Earlier this month, several publications reported that activist investor Elliott Investment Management had acquired nearly a $5 billion stake in the company and would push for asset sales and curb renewables investments.

Over the past year, BP stock has fallen 7.6%.

Also See: B. Riley Retail Traders Eye Short Covering As Next Key Catalyst After Nasdaq Compliance Win

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)