Advertisement|Remove ads.

Brighthouse Financial Stock Surges Pre-Market After $4.1 Billion Acquisition By Aquarian Capital Gets Finalized

- Aquarian Capital’s offer implies a 35% premium to Brighthouse’s stock price at Wednesday’s close.

- The transaction is expected to close in 2026.

- Eric Steigerwalt will remain President and CEO of Brighthouse after the acquisition.

Brighthouse Financial, Inc. (BHF) shares surged 29% in premarket trade on Thursday after Aquarian Capital LLC announced a merger agreement to acquire the insurance firm for $70 per share in an all-cash transaction valued at around $4.1 billion.

The offer implies a 35% premium to Brighthouse’s share price as of Wednesday’s close.

Under the agreement, Brighthouse Financial will continue to operate as a standalone entity within Aquarian’s portfolio following the closing, which is expected in 2026. Eric Steigerwalt will remain President and CEO of Brighthouse, and the company will retain its headquarters in Charlotte, as well as its brand identity.

Aquarian Capital announced its intention to invest in Brighthouse’s platform, distribution franchise, and product innovation, while also enhancing its investment management capabilities through a partnership with Aquarian Investments, its asset management arm.

“The acquisition of Brighthouse Financial aligns perfectly with our strategic focus on the United States retirement market, which represents a significant and growing opportunity,” said Rudy Sahay, Founder and Managing Partner of Aquarian Capital.

Funding Of The Deal

The merger will be funded through committed financing, requiring no additional debt from either company’s insurance subsidiaries. All preferred shares, senior notes, and subordinated debentures will remain outstanding with their current rights and terms.

RBC Capital Markets LLC will serve as the exclusive financial advisor for the transaction, while Wells Fargo and Goldman Sachs will serve as financial advisors.

Last week, the Financial Times reported that Mubadala Capital, which invested $1.5 billion in Aquarian last year, is expected to provide equity funding, while a consortium of banks is expected to arrange over $1 billion in debt financing.

The auction for Brighthouse reportedly attracted interest from major private equity firms, including Apollo, Carlyle, TPG, and Sixth Street, though several dropped out during due diligence.

Sixth Street had previously offered about $55 per share to acquire Brighthouse, valuing the life insurer at roughly $3.1 billion, according to a Reuters report last month.

What Are Stocktwits Users Saying?

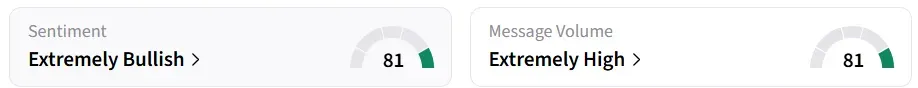

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ territory for the past 24 hours, accompanied by ‘extremely high’ message volumes.

Stocktwits users expressed optimism following the announcement.

Year-to-date, BHF stock has gained 7.3%

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)