Advertisement|Remove ads.

Broadcom’s Blockbuster Quarter Underscores AI Strength — Did CEO’s Measured Comments Keep Shares From Soaring?

- Momentum Remains Strong, with revenue growth re-accelerating as AI chip sales soared 74% YoY.

- The company now expects AI revenue to double to $8.2 billion this quarter.

- A $73B backlog and a 48× forward P/E left investors questioning whether too much optimism is already priced in.

Broadcom Corp. (AVGO) avoided making the bold predictions that Oracle did, yet its stock met a similar fate after its earnings report. The post-results reaction — or more precisely, the post-earnings-call reversal — underscores how jittery the market has become around artificial intelligence (AI) trades.

The stock initially climbed nearly 3% in after-hours trading, but the gains vanished once the earnings call began. By overnight trading, Broadcom shares were down more than 4%, according to Yahoo Finance.

Was it CEO Hock Tan’s guarded commentary that weighed on the stock, or are investors signaling that Broadcom has already priced in too much, too quickly? In any case, there’s no doubt that Broadcom delivered a blockbuster, and the numbers leave little room for debate.

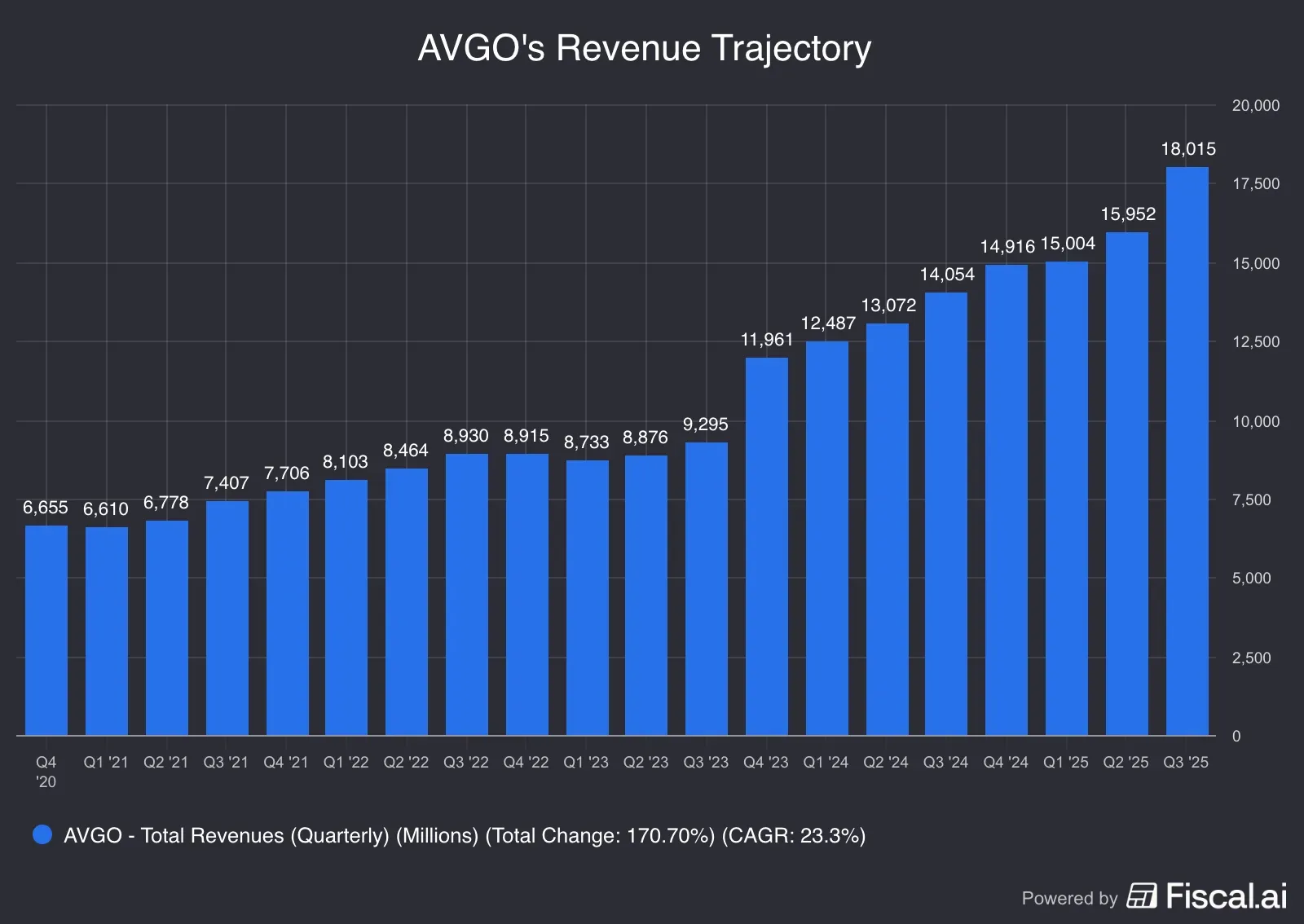

Long Streak Of ‘Standout’ Growth

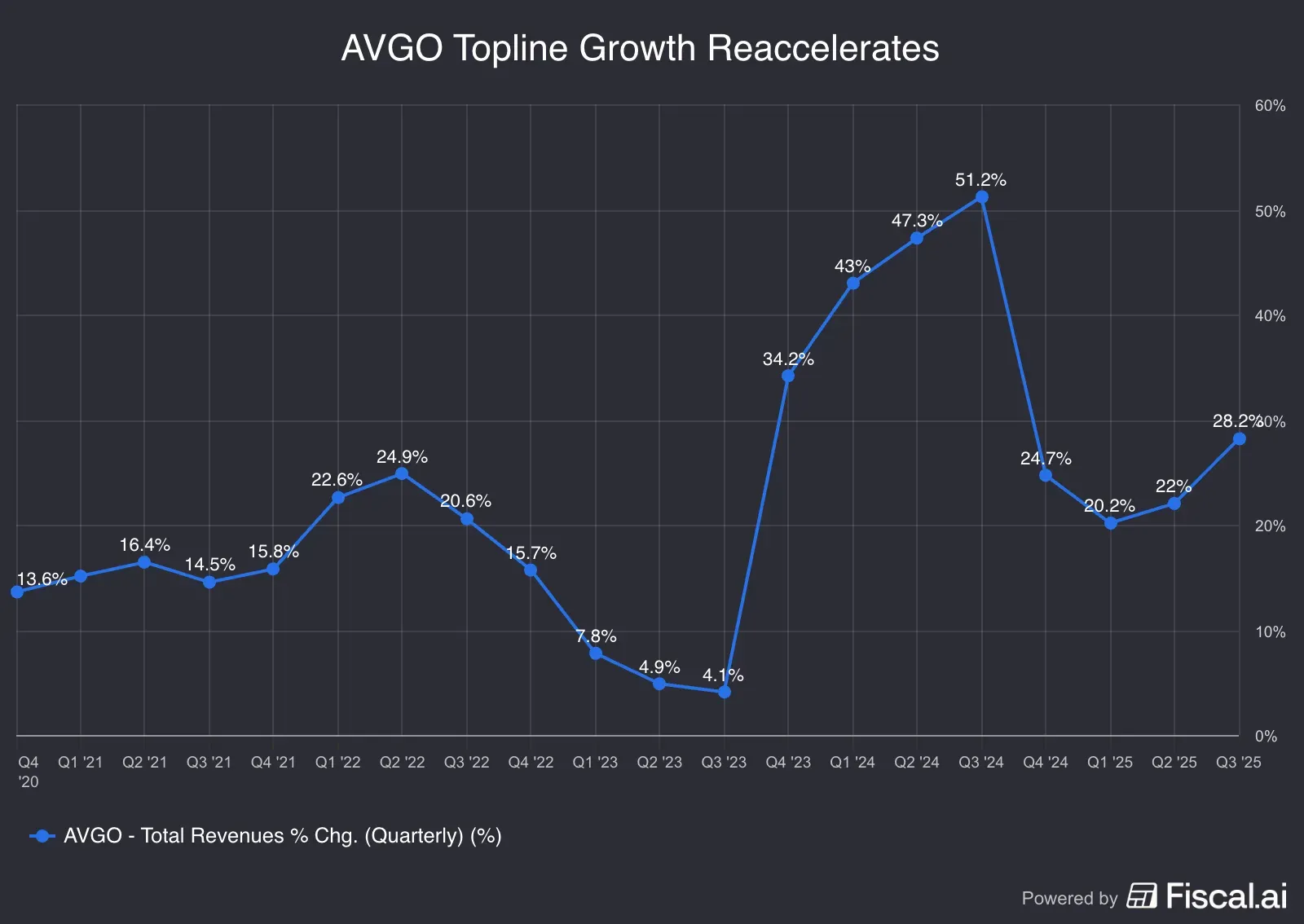

Since the second quarter of calendar 2023, revenue has grown year over year in every quarter, although the growth rate slowed from more than 50% in the third quarter of last year. Note that Broadcom’s fiscal quarters run one quarter ahead of the calendar year.

Source: Fiscal.ai

After decelerating for two quarters, revenue growth has inflected higher as AI chip demand exploded. The guidance issued for the current quarter envisages the company sustaining the growth seen in the preceding one (28%) versus the guidance that calls for nearly 23% growth.

Source: Fiscal.ai

The Palo Alto, California-based company’s September quarter revenue was a record, underpinned by a 74% YoY jump in AI chip revenue. More importantly, the company guided the AI chip revenue to double to $8.2 billion in the current quarter.

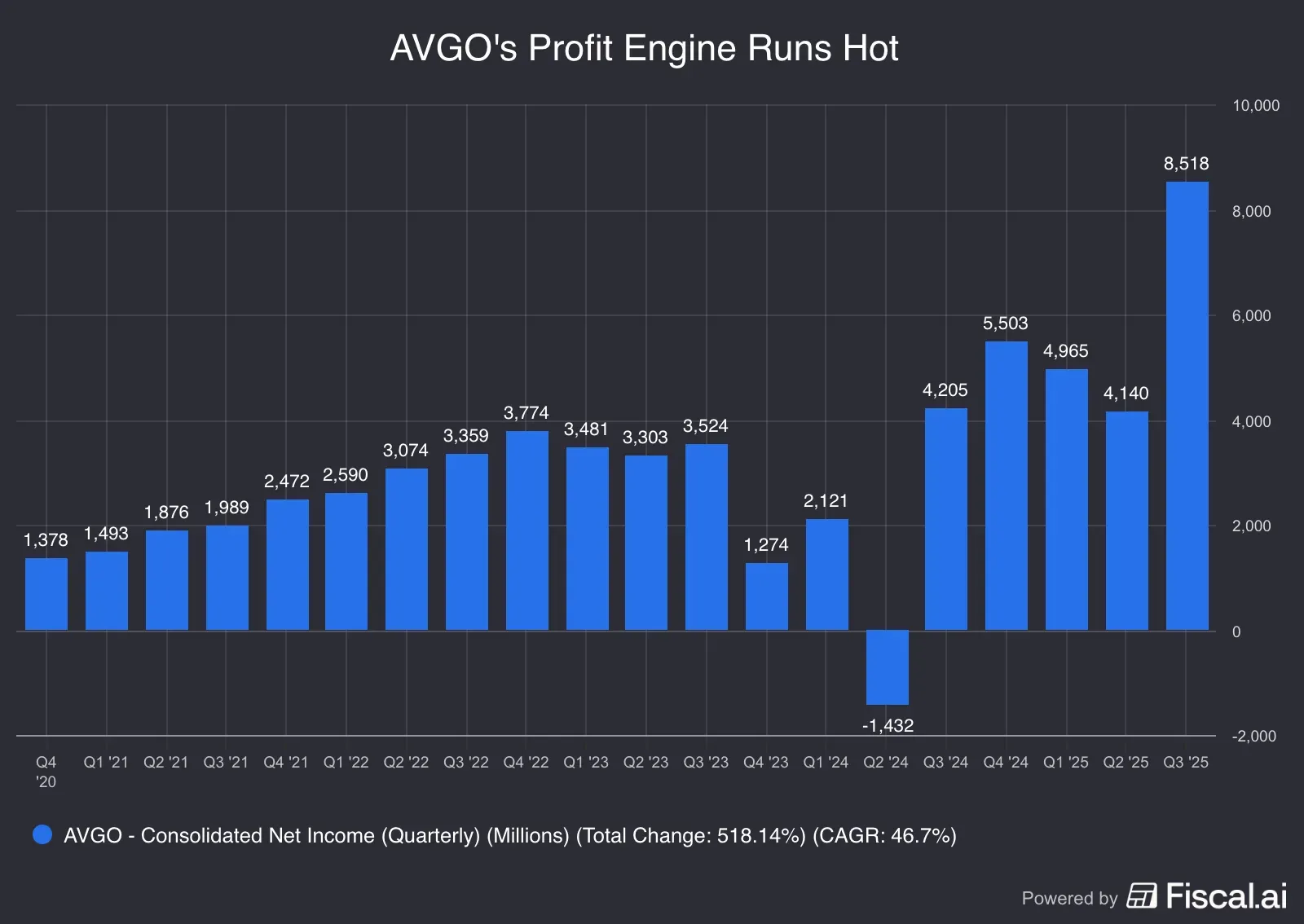

Broadcom has also been a consistent profit earner. Its second-quarter 2024 results were an outlier; a one-time non-cash tax provision of $4.5 billion related to an intra-group transfer of intellectual property rights to the U.S. as part of a supply-chain realignment dragged the unadjusted bottom-line result into the red.

Source: Fiscal.ai

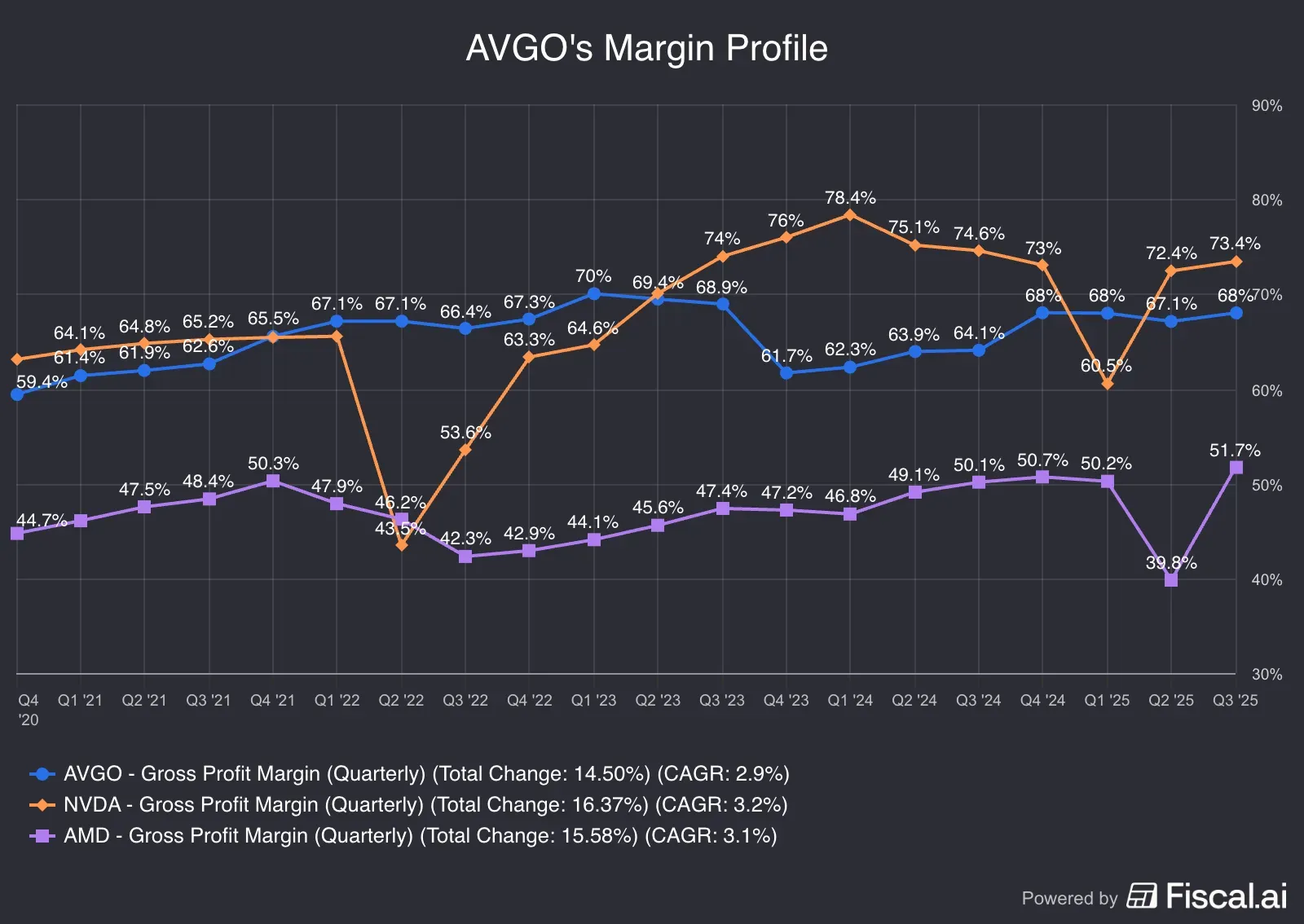

Margin - Source of Worry?

On the earnings call, CFO Kristine Spears said gross margin contracted 50 basis points (bps) sequentially, with the chip product mix blamed for the predicament, according to a transcript made available by Koyfin. In Q4, Broadcom’s chip solutions business, which made up about 62% of the total revenue, carried a gross margin of 68%, while the infrastructure software segment had a higher 93% margin.

Broadcom now models a 100 bps sequential contraction in the current quarter. The company also forecast a percentage point sequential decline in its adjusted earnings before interest, taxes, depreciation and amortization (EBITDA).

Source: Fiscal.ai

Backlog Underwhelms?

A $73 billion order that Tan flaunted may sound measly compared to the $523.3 billion in backlog plus deferred revenue that Oracle guided. On the earnings call, Tan said the number pertains to what will be delivered over the next 18 months.

When an analyst asked if the estimate was a base-case scenario, Tan replied in the affirmative.

“So, taking that we expect revenue -- a minimum revenue one way to look at it of $73 billion over the next 6 quarters, but we do expect much more as more orders come in for shipments within the next 6 quarters.”

The executive also clarified that more than 70% pertains to XPUs — the highly customized application-specific eXtreme processing units used for AI applications.

Tan Tight-Lipped On 2026 Specifics

The Broadcom CEO gave only a qualitative perspective on what 2026 would look like.

“Directionally, we expect AI revenue to continue to accelerate and drive most of our growth. And non-AI semiconductor revenue to be stable. Infrastructure software revenue will continue to be driven by VMware growth at low double digits.”

He also said it’s hard to predict 2026 performance precisely, calling “Now moving is a moving number as we move in time.”

“So I'd rather not give you guys any guidance, and that's why we don't give you guidance.”

Is Valuation Deterrent?

Broadcom stock has gained more than 76% this year, outperforming the broader market, the tech sector and the semiconductor industry.

Source: Koyfin

Source: Koyfin

The forward price-earnings (P/E) multiple, a key valuation metric, is at 48.2, implying that the stock is a pricier investment compared to the S&P 500’s 22.5, the IT industry’s 28.2 and the semiconductor industry’s 30.

Retail, Analyst Relish AVGO’s Q4

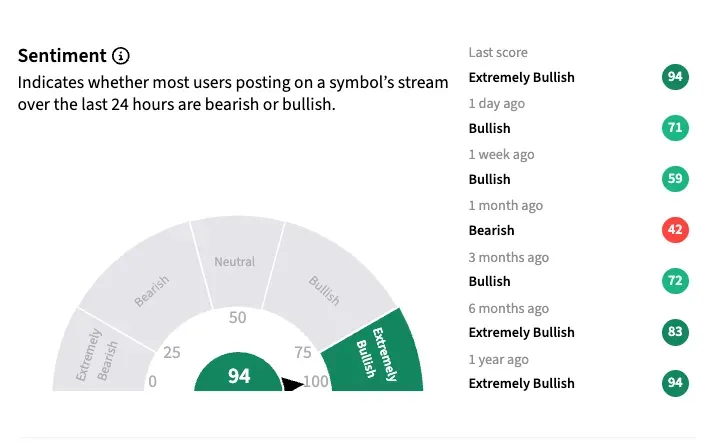

The adverse stock reaction did little to dissuade retail traders, with Stocktwits sentiment soaring after the Q4 report. On Stocktwits, the sentiment meter pointed to an ‘extremely bullish’ stance as of early Friday, an improvement from the ‘bullish’ mood seen the day before. The mood toward the stock has remained broadly buoyant throughout the past year.

Retail chatter on the AVGO stream also grew louder to ‘extremely high’ levels. A bullish watcher’s comments summarized retail’s mood — ‘A stock you own; You do not trade it.” They were leaning bullish, sensing the setup for a strong, durable move higher.

“Always a bull,” another proudly proclaimed, who apparently wants to hold the stock. They lauded the company for an “impressive” earnings report and felt Broadcom’s Hock did not care about “external noises.”

Following the Q4 print, Baird’s Tristan Gerra hiked his price target on Broadcom to $420 from $300 — a massive increase — while reiterating an ‘Overweight’ rating. Gerra pointed to strong deal momentum, highlighting the additional $11 billion order, entirely from Anthropic, the company’s fourth customer, on top of the $10 billion announced in the prior quarter.

He also flagged that Broadcom has now secured a fifth customer for its XPUs. Gerra added that OpenAI-related revenue should flow through 2027–2029, assuming a low-$20 billion revenue per gigawatt range.

According to Koyfin, 94% of the analysts covering the stock (44 of 47) rate the stock as a ‘Buy’ or a ‘Strong Buy.’ Three chose to remain on the sidelines. It is probably one of the very few stocks that have no ‘Sell’ recommendation.

The upside potential, however, is only about 1.5%, based on the average analyst price target from Wall Street firms.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Moderna And Super Micro Top S&P 500 Short Interest List — Are They Ripe For A Squeeze?

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iran_natanz_nuclear_facility_jpg_ca08028936.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234618957_jpg_1c670c00ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_charles_hoskinson_OG_jpg_7eaff6116d.webp)