Advertisement|Remove ads.

Moderna And Super Micro Top S&P 500 Short Interest List — Are They Ripe For A Squeeze?

- Super Micro's headwinds stemming from AI-bubble fears contrast with improving compliance, new Nvidia-powered products, and a more reasonable valuation.

- Moderna continues to struggle post-pandemic, with weak fundamentals, no new blockbusters, and higher regulatory scrutiny weighing on its pipeline.

- Analysts see greater upside for Super Micro than Moderna, while retail sentiment remains cautious toward both stocks.

Investing in heavily shorted stocks isn't for the faint-hearted. While they can offer meaningful upside, that potential comes with heightened volatility and elevated risk. More often than not, they are shorted for legitimate reasons. But if the sentiment flips, these stocks can deliver explosive gains. The most-shorted S&P 500 list currently includes two names that won't surprise many investors.

Moderna — the biopharma that, along with Pfizer, led the COVID-19 vaccine race — rode a historic wave of demand during the pandemic. But as the outbreak faded and vaccine sales collapsed, the company's fundamentals have come under pressure despite efforts to sustain momentum with second-generation and combination shots. The company is still searching for its next blockbuster therapy.

Super Micro Computer, Inc. (SMCI), which rode the artificial intelligence mania, selling AI servers, was once touted as a promising opportunity. The company, however, ran into rough weather in 2024 amid accusations of accounting issues, delays in filing of financial reports, and attacks from short-sellers.

Since peaking at $122.90 on March 8, 2024, the stock has traded broadly downward for the rest of the year. Super Micro's addition to the S&P 500 provided a boost, but it failed to reignite the uptrend. Notably, the company was removed from the Nasdaq 100 just five months after its inclusion in the tech index.

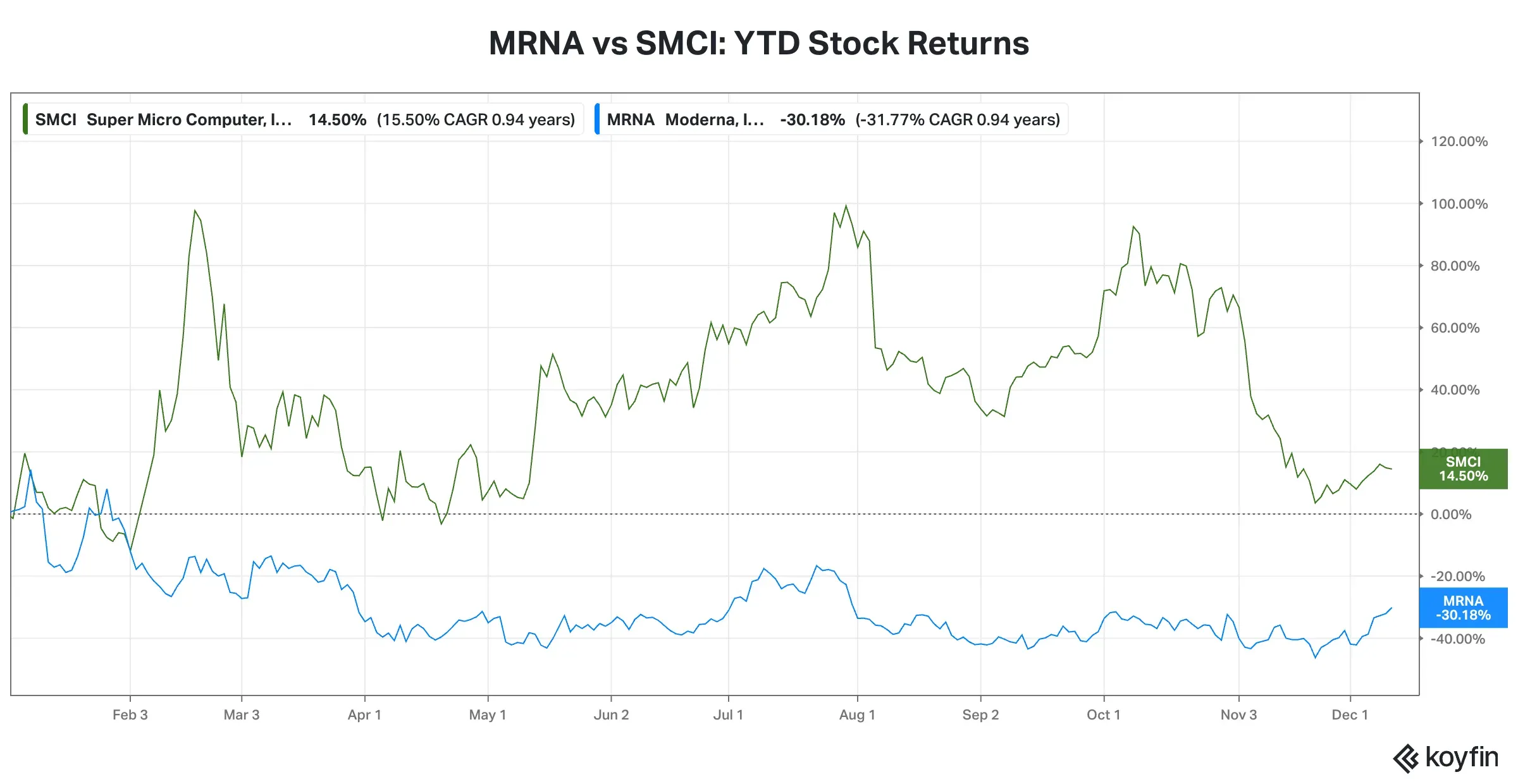

Stock Returns This Year

As Super Micro became compliant with the listing requirements for timely quarterly reporting, buyers returned to the stock. The SMCI stock also benefited from the company's new offerings involving Nvidia's newest high-performance chips and its positive long-term outlook. Its near-term underperformance raised concerns among investors.

After rising through the first quarter, Super Micro's stock pulled back and hit a low in mid-November and has been consolidating since.

Moderna's stock was on a steady downward trajectory this year, barring occasional consolidation moves.

Source: Koyfin

Source: Koyfin

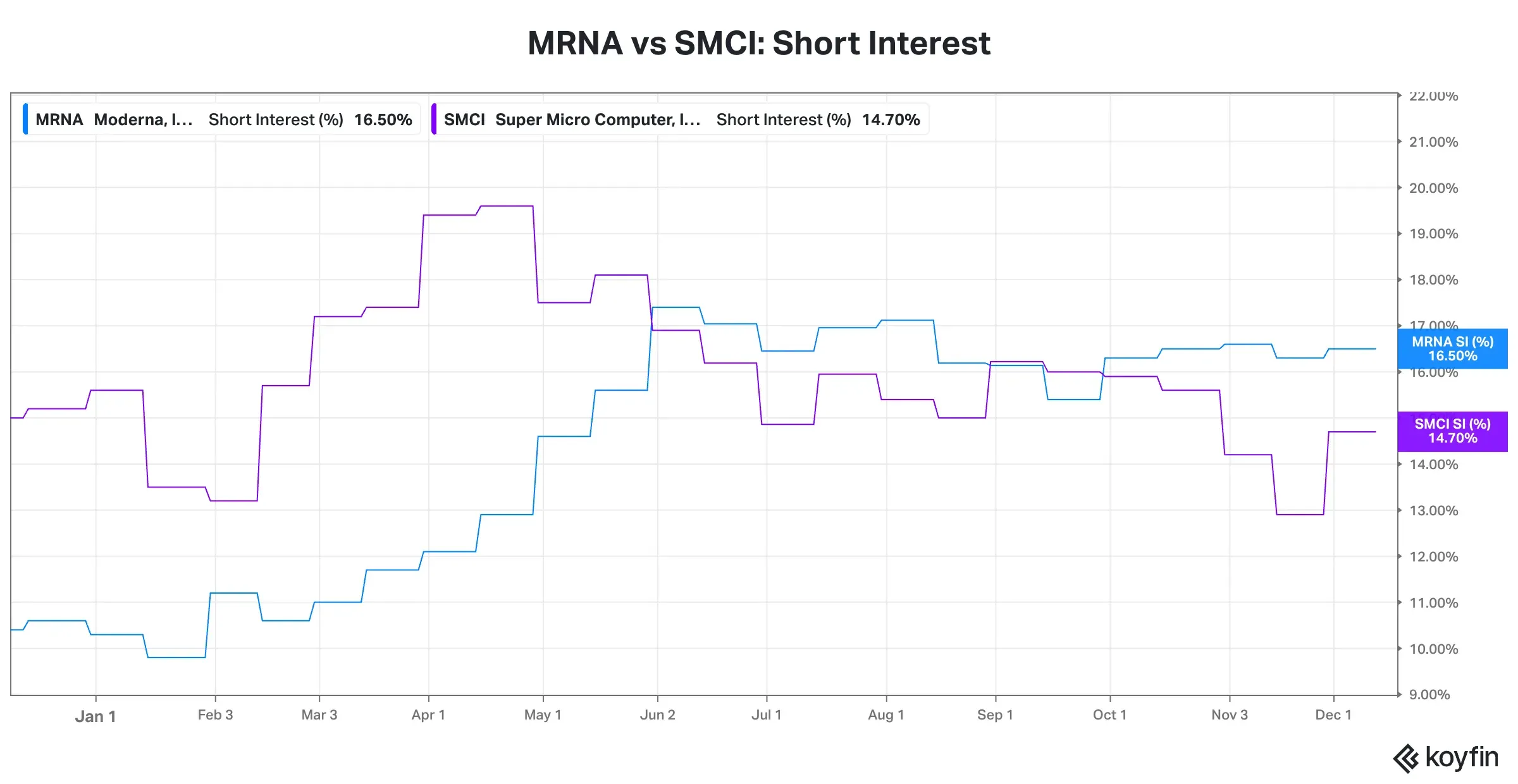

Elevated Short Bets

According to Koyfin, the short interest for Super Micro peaked in April (19.60%) before reducing to 14.70% currently. Moderna's short interest, though off its May peak of 17.40%, has declined by less than one percentage point.

Source: Koyfin

Time To Revisit?

Super Micro now trades at a relatively reasonable valuation (in terms of the forward price-earnings (P/E) multiple versus the tech sector and its peak multiple).

Source: Fiscal.ai

Moderna, on the other hand, trades at a much higher price-to-sales (P/S) multiple than it did last July. Since Moderna is projected to report losses over the next year, the P/E ratio isn't applicable.

Source: Fiscal.ai

According to Koyfin-compiled consensus analysts' stock price targets for the companies, estimates, Super Micro has an upside potential of 39% versus 23% for Moderna.

Super Micro has an equal share of analysts who are bullish and neutral on the stock. Meanwhile, more analysts are on the sidelines of Moderna (15 of the 22 analysts covering the stock).

On Stocktwits, retail traders are 'bearish' on Super Micro as of early Thursday, while Moderna elicited 'neutral' sentiment.

For Super Micro, simmering AI bubble fears could remain an overhang on the stock. Still, if the company can execute its plans and leverage its partnership with Nvidia, the stock could see a reversal in fortunes. Moderna, meanwhile, remains a "show-me" story as it has to prove the mettle of the rest of its pipeline. Moderna also faces regulatory uncertainty as the FDA applies heightened scrutiny to new vaccines and therapeutics, adding another layer of risk to its pipeline.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Powell Didn't Surprise — But Markets Might: How Retail Traders Are Positioning After Fed's Rate Cut

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)