Advertisement|Remove ads.

Budweiser Parent's Stock Loses More Kick After Price-Target Cuts: Retail Also Worries

Shares of Anheuser-Busch InBev ($BUD) dropped over 1% on Monday afternoon, on track to mark their fifth consecutive day of losses.

This slide follows underwhelming third-quarter (Q3) results reported last week, with sales volume dipping 2.4% year-over-year (YoY) due to weak demand in China and Argentina.

Revenue for the quarter grew 2.1% organically to $15.6 billion — missing the 3.5% growth expected by analysts — though earnings per share (EPS) rose 14% to $0.98, slightly above the forecasted $0.92.

Following the earnings report, Barclays and Citi cut their price targets on AB InBev shares, lowering their expectations to €69.22 and €67, respectively, though both firms maintained ‘Overweight’ and ‘Buy’ ratings.

U.S. sales increased by 1.8%, supported by price hikes and an extra selling day, with Michelob Ultra and Busch Light contributing to market share gains.

However, sales volume in the U.S. declined 0.4% YoY, reflecting ongoing consumer backlash after the Bud Light controversy involving transgender influencer Dylan Mulvaney last spring.

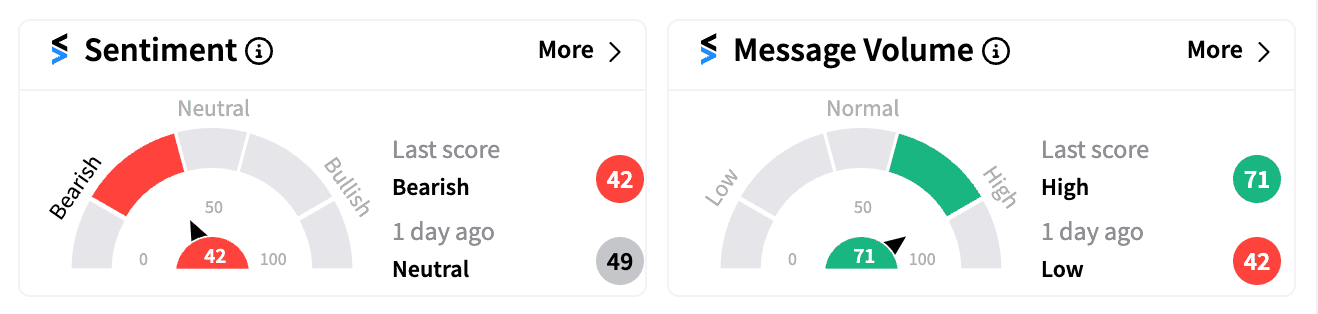

Retail sentiment on Stocktwits leaned ‘bearish’ on Monday afternoon, with several messages turning political amid the upcoming U.S. election.

ADR shares of AB InBev are down over 8% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

Read next: Root’s Stock Shoots Up After Price-Target Hikes: Here's How Retail's Reacting

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)