Advertisement|Remove ads.

Bull Run Ahead? Retail Traders Bet Big On Q3 US Market Rally Amid Lingering Trump Tariff Worries

U.S. stocks have shown resilience amid the threat posed by President Donald Trump’s tariffs, but the recovery has been interspersed by pullbacks, rendering the market volatile.

The S&P 500 hit a new high last Thursday, only to retreat in the very next session. The unfolding week promises more volatility, given the release of key first-tier economic data and the onset of the second-quarter reporting season.

The SPDR S&P 500 ETF (SPY) and the Invesco QQQ Trust (QQQ), exchange-traded funds (ETFs) that track the S&P 500 Index and the Nasdaq 100 Index, are up 7.04% and 8.69%, respectively, for the year.

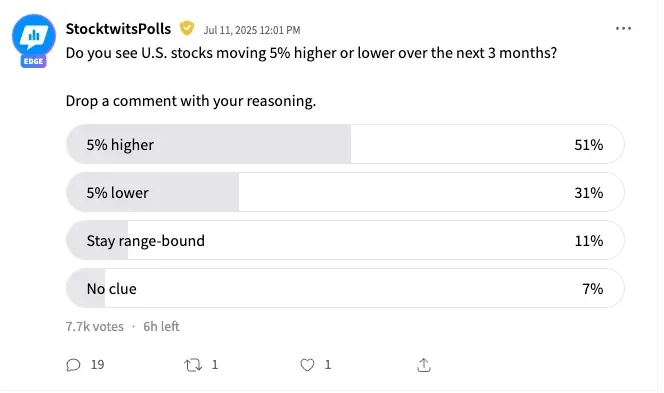

An ongoing Stocktwits poll that asked users, “Do you see U.S. stocks moving 5% higher or lower over the next 3 months?” found that more than half of the respondents (51%) expected the market to move 5% higher over the next three months.

A far less 11% expect stocks to remain range-bound, and 7% were clueless about the near-term direction, while 31% said they expect stocks to fall by 5%.

Those users who are bullish premised their optimism on their hope that trade and tariff issues will be eventually ironed out. Another user echoed similar hopes.

A bearish user feared an adverse cyclical economic effect and called for a steeper 20-30% drop in U.S. stocks. “GDP will continue to drop, companies are starting another round of layoffs. US consumers will be hit with tariff-related inflation,” they said.

In Monday’s early premarket trading, the SPY ETF fell 0.34% and the Nasdaq ETF was down 0.33%.

The QQQ ETF was among the top 20 trending tickers on Stocktwits early Monday, while the SPY and QQQ ETF were among the top five active tickers. Sentiment toward the SPY ETF was ‘bearish’ amid the tariff uncertainties, while that toward the QQQ ETF was ‘bullish.’

Several analysts expect the second half of this year to bring in additional catalysts such as Fed funds rate cuts, AI-fueled earnings outperformance, and seasonal strength.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)