Advertisement|Remove ads.

Buy Biocon, Zydus Life For Short-Term Gains, Says SEBI RA Vinayak Gautam After Fresh Regulatory Approvals

Biocon and Zydus Lifesciences are in the spotlight with fresh regulatory approvals fueling bullish analyst sentiment and renewed retail interest.

Biocon shares rose 2% on Wednesday after its subsidiary received approval from the U.S. Food and Drug Administration (FDA) for its diabetes drug. The stock is trading near its 52-week high. The other pharma stock on the analyst’s radar is Zydus Lifesciences after it secured regulatory approval for a nonsteroidal anti-inflammatory drug.

Here’s why the analyst is bullish on these two pharma counters:

Biocon

Biocon Biologics, its arm, secured this approval for its rapid-acting insulin, Kirsty (Insulin Aspart-xjhz). This is an important milestone for Biocon as this drug is the first and only interchangeable biosimilar to NovoLog (Insulin Aspart) in the United States.

KIRSTY is a rapid-acting human insulin analog used to improve glycemic control in both adult and pediatric patients with diabetes mellitus.

SEBI-registered analyst Vinayak Gautam is bullish on Biocon and recommended buying it at ₹390, with a target price of ₹410 over a one-week timeframe. He advised maintaining a stop loss at ₹380.

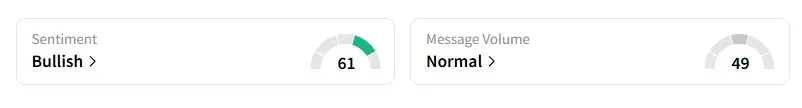

Data on Stocktwits shows that retail sentiment has turned ‘bullish’ on this counter from ‘bearish’ last week.

Biocon shares have risen 10% year-to-date (YTD).

Zydus Lifesciences

The US Food and Drug Administration (USFDA) has granted final approval for the company’s Celecoxib capsules in 50 mg, 100 mg, 200 mg, and 400 mg strengths. Celecoxib is prescribed to relieve pain and inflammation associated with conditions such as arthritis, ankylosing spondylitis, and menstrual discomfort.

Gautam is bullish on Zydus Life and recommended buying it at ₹967, with a target price of ₹1,010, over a one-week timeframe. He advised maintaining a stop loss at ₹950.

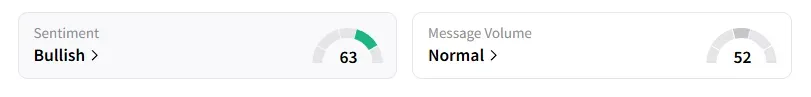

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago on this counter.

Zydus Life shares are flat year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)