Advertisement|Remove ads.

Candel Therapeutics Stock Soars On FDA’s RMAT Designation For Prostate Cancer Therapy: Retail Considers It Good Long-Term Buy

Shares of Candel Therapeutics, Inc. (CADL) traded 8% higher on Wednesday morning after the U.S. Food and Drug Administration (FDA) granted Regenerative Medicine Advanced Therapy (RMAT) designation to its lead immunotherapy candidate CAN-2409 for the treatment of a certain kind of prostate cancer.

CAN-2409 is being studied for the treatment of newly diagnosed localized prostate cancer in patients with intermediate-to-high-risk disease and was previously granted FDA Fast Track designation for the same indication.

RMAT designations are intended to expedite the development and review of regenerative medicine therapies intended to treat, modify, reverse, or cure serious or life-threatening diseases where preliminary clinical evidence indicates that the drug has the potential to address unmet medical needs for such disease or condition.

Candel’s lead candidate was granted the designation based on positive data from a late-stage trial evaluating the efficacy and safety of the investigational drug plus a prodrug, together with external beam radiation therapy, in newly diagnosed, localized, intermediate-to-high-risk prostate cancer.

Candel CEO Paul Peter Tak said that the company looks forward to collaborating with the FDA on an expedited approval for the immunotherapy candidate once it submits its Biologics License Application (BLA) seeking permission to commercialize. The company is looking to submit the application by the end of 2026.

RMAT designations offer the company access to mechanisms designed to fast-track BLA review and approval.

CAN-2409 is also being studied for the treatment of pancreatic cancer and non-small cell lung cancer.

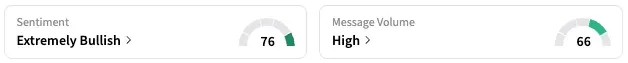

On Stocktwits, retail sentiment around Candel jumped from ‘bullish’ to ‘extremely bullish’ over the past 24 hours while message volume jumped from ‘normal’ to ‘high’ levels.

A Stocktwits user opined that the shares are suitable for holding in the mid- to long-term.

According to data from Koyfin, all three analysts covering CADL rate it a ‘Buy.’ The stock has an average price target of $21.67, implying an upside of over 200% from its current value.

CADL stock is down by about 33% this year and by about 30% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_New_York_Times_resized_jpg_37d8dd3b33.webp)