Advertisement|Remove ads.

Nikola Stock Dives After Company Files For Chapter 11 Bankruptcy Protection: Retail’s Frustrated

Shares of Nikola Corp. (NKLA) plunged on Wednesday after the EV-maker filed for Chapter 11 bankruptcy protection following its failure to raise capital and preserve cash for its operations.

The company has also filed a motion seeking authorization to pursue an auction and sale process under Section 363 of the U.S. Bankruptcy Code.

Nikola said it has approximately $47 million in cash on hand to fund the foregoing activities, implement the post-petition sale process, and exit Chapter 11 through a planned process.

The company also intends to request the Court’s permission to sell its assets within a timeline that balances its liquidity needs with its significant pre-petition marketing efforts.

CEO Steve Girsky said that in recent months, the company has taken several actions to raise capital, reduce liabilities, clean up its balance sheet, and preserve cash to sustain its operations.

“Unfortunately, our very best efforts have not been enough to overcome these significant challenges, and the Board has determined that Chapter 11 represents the best possible path forward under the circumstances for the Company and its stakeholders,” he said.

Nikola believes a structured sale process is the best possible solution to maximize the value of its assets. Hence, it intends to market and sell its assets and effectuate an orderly winddown of its businesses.

If the Court permits, the proposed bidding procedures would allow interested parties to submit binding offers to acquire Nikola's assets, which would be purchased free and clear of Nikola's indebtedness and certain liabilities.

Nikola was once a darling of Wall Street, valued at approximately $30 billion, and considered the “next big thing.” However, scandals and lies surrounding founder and former chairman and CEO, Trevor Milton sparked the firm’s downfall, according to a CNBC report.

In 2022, Milton was convicted of wire fraud and securities fraud for misleading investors about the company's operations and zero-emissions technology, the report added.

The now defunct Hindenburg Research, known for taking short positions based on extensive research, made these controversies public, the report added.

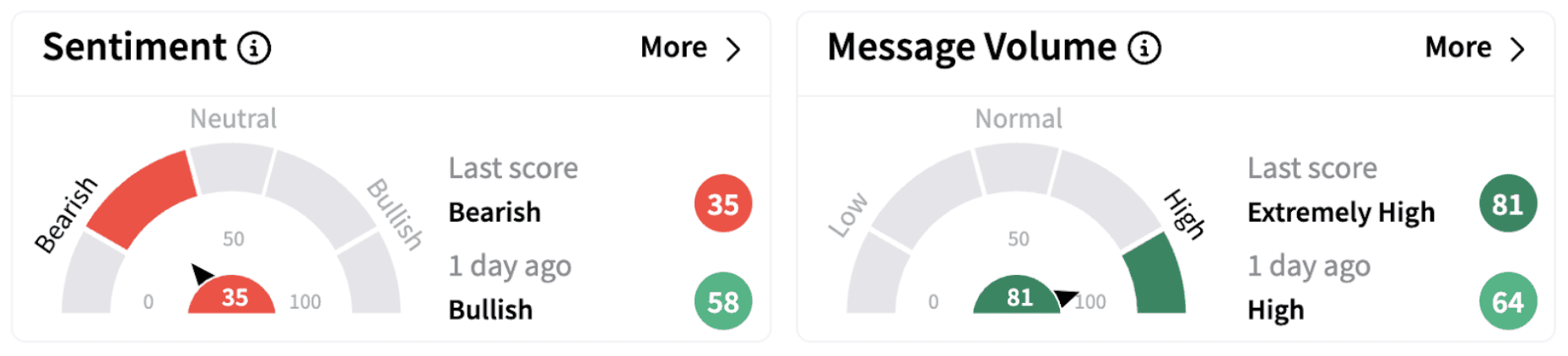

Not surprisingly, retail sentiment on Stocktwits flipped into the ‘bearish’ territory (35/100) accompanied by high retail chatter.

Retail investors on Stocktwits expressed frustration following the development.

Nikola Stock is down over 63% in 2025 and has lost nearly 98% of its market cap over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231498932_jpg_bdd44fc548.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AEHR_chip_maker_3698bf2343.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870269_jpg_b38339787f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)