Advertisement|Remove ads.

Casey’s General Stores Stock Surges On Q3 Earnings Beat, But Retail’s Downbeat On Economic Concerns

Shares of convenience chain Casey’s General Stores rose 3.25% in after-hours trading following stronger-than-expected fiscal third-quarter earnings, but retail sentiment stayed bearish.

Casey’s earnings per share (EPS) came in at $2.33, beating Wall Street’s expectations of $2.00. The company’s revenue stood at $3.9 billion, beating estimates of $3.72 billion.

The company’s inside same-store sales rose 3.7% year-over-year, and total fuel gallons sold increased 20.4%.

"Casey's delivered an excellent third quarter highlighted by strong sales growth inside and outside the store,” said Darren Rebelez, Casey’s chairman and CEO. “Inside same-store sales were driven by the prepared food and dispensed beverage category, with hot sandwiches and bakery performing quite well.”

For 2025, the company expects same-store inside sales to increase about 3% to 5%, while inside same-store margins are forecast to be comparable to the prior year. It expects earnings before interest, taxes, depreciation, and amortization (EBITDA) to increase about 11%.

Casey’s also approved a quarterly dividend of $0.50 per share, payable May 15,

2025, to shareholders of record on May 1. It expects same-store fuel gallons sold to be negative 1% to positive 1%.

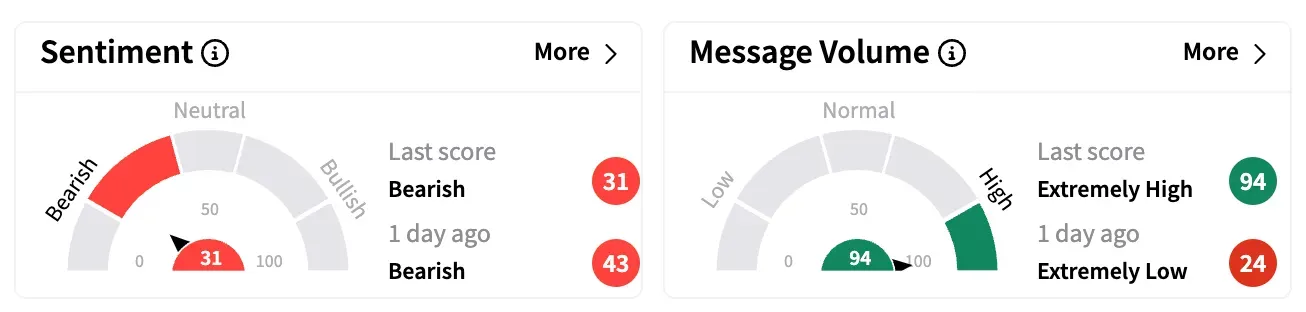

Retail sentiment on Stocktwits remained in the ‘bearish’ zone. Message volume increased to ‘extremely high’ from ‘extremely low’

One bearish-leaning watcher called the move a short-term downtrend amid the economic uncertainty.

Another predicted a drop below $350.

Casey’s stock is down 4.4% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)