Advertisement|Remove ads.

Greenbrier Flags Trump Trade Uncertainty After Q2 Profit Miss: Retail On Wait-And-Watch Mode

Greenbrier Cos (GBX) stock fell 2.9% after-hours on Monday after the company’s fiscal second-quarter earnings missed Wall Street’s estimates.

According to FinChat data, the railcar lessor reported core earnings of $1.69 per share for the quarter ended Feb. 28, while analysts expected it to post $1.78 per share in earnings.

The company’s quarterly revenue fell to $762 million from $862.7 million a year earlier. Wall Street was expecting the company to post $898.5 million in revenue.

The company builds and markets freight railcars in North America, Europe, and Brazil and owns a lease fleet of approximately 16,700 railcars.

The company said revenue declined sequentially due to fewer deliveries in North America and Europe, reflecting the timing of syndication activity and planned production changes.

Greenbrier lowered its fiscal 2025 revenue forecast to $3.15 billion and $3.35 billion compared with $3.35 billion to $3.65 billion, as projected earlier.

It also lowered its railcar delivery expectations for the fiscal year between 21,500 and 23,500 units, compared with the 22,500 to 25,000 units forecasted earlier.

“Our pipeline remains robust, but inquiries have been slow to translate into orders as customers have been waiting clarity on U.S. trade policy,” company executive Brian Comstock said during a conference call with analysts.

The company said it would close a facility in Romania, reducing deliveries from its European facilities in the second half of the fiscal year 2025.

Greenbrier also said its products comply with the United States- Mexico- Canada Agreement but it is working to protect margins from steel tariffs imposed by the U.S.

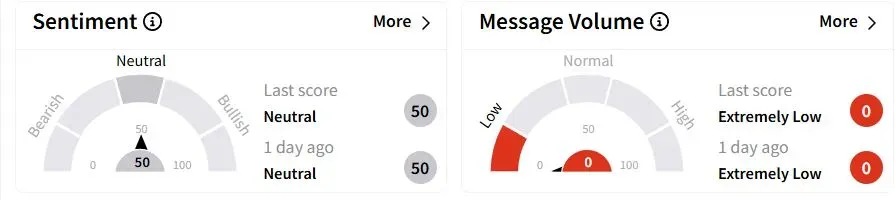

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (82/100) territory from ‘neutral’(53/100) a day ago, while retail chatter remained ‘neutral.’

The stock has seen a 2.9% rise in followers over the past three months.

Greenbrier shares have fallen 27.2% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)