Advertisement|Remove ads.

CDSL Shares Tank 12% In A Week: SEBI RA Sees Short-term Volatility But Long-term Prospects Remain Intact

After a rally that took Central Depository Services (India) shares to ₹1,830 from ₹1,400, the stock has been on a steady decline. Over the past week, it has shed over 12%.

According to Sudhansu Sekhar Panda, a SEBI-registered analyst at Bluemoon Research, CDSL shares are showing signs of weakness in the short term.

However, a key demand zone lies between ₹1,380 and ₹1,400, an area where the stock previously saw an inverted head and shoulders breakout on the daily chart, according to Panda. Given the current downtrend, the probability of retesting the support zone remains high.

If the stock holds above the support level, it could offer a solid opportunity to accumulate for medium- to long-term portfolios.

On the upside, Panda flagged ₹1,830 as a strong resistance price. A sustained move above could trigger a fresh breakout, potentially pushing the stock toward ₹2,000 - ₹2,200 levels, a 20% upside considering the upper end of the range.

In a worst-case scenario, if the stock falls below the ₹1,380-1,400 level, it could present an additional buying opportunity for long-term investors willing to stay patient, the analyst said. The next major support is near ₹1,050.

Fundamentally, the stock remains strong, and while short-term volatility and market sentiment may weigh on prices, CDSL continues to present a promising long-term opportunity.

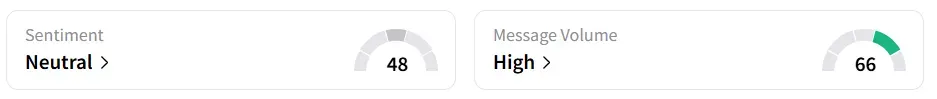

Ahead of peer NSDL’s IPO, retail chatter on CSDL has also increased. Message volumes for CDSL on Stocktwits were ‘high,’ while sentiment turned ‘neutral’ from ‘bullish’ a day earlier.

Year-to-date, CDSL shares have declined more than 15%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)