Advertisement|Remove ads.

CenterPoint Energy Stock Slips After $800M Stock Offering, Boosts Capital Plan On Data Center Demand: Retail’s Bullish

CenterPoint Energy (CNP) shares fell 1.9% in extended trading on Tuesday after the utility firm launched a public offering of its common stock worth $800 million, after raising its 10-year capital spending plan by $4 billion.

The company said that BofA Securities, Mizuho, J.P. Morgan, Barclays, Citigroup, and RBC Capital Markets are acting as joint book-running managers for the offering.

CenterPoint is among the nation’s largest natural gas and electric utilities. Its gas business alone serves 7 million customers in Indiana, Minnesota, Ohio, and Texas.

Concerning the offering, CenterPoint will enter into separate forward sale agreements with Bank of America, N.A., Mizuho Markets Americas LLC, and JPMorgan Chase Bank, National Association. The settlement of the forward sale agreements is expected to occur on or before Feb. 25, 2027.

The company expects to use the net proceeds for general corporate purposes, possibly including repayment of commercial paper or other debt.

Separately, the company raised its long-term capital spending plan to $52.5 billion through 2030, attributed to its spending in Texas.

Electric Reliability Council of Texas (ERCOT), the state's grid operator, had projected electricity demand to rise to 218 gigawatt (GW) in 2031, compared with the previous peak of 85.5 GW in the summer of 2023.

The bulk of the growth would come from data centers, and electricity suppliers will have to install thousands of miles of new, long-distance transmission lines, which could cost up to $30 billion, according to ERCOT estimates.

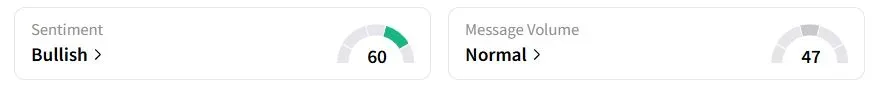

Retail sentiment on Stocktwits was in the ‘bullish’ (60/100) territory, while retail chatter was ‘normal.’

CenterPoint stock has gained 17.9% year-to-date (YTD).

Also See: Tesla Investors Look Past Europe Sales Slump As Musk Says He's 'Back To Spending 24/7 At Work'

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)