Advertisement|Remove ads.

CervoMed Dementia Drug Slows Disease Progression In Study: Retail Loads Up On The Stock

CervoMed Inc. (CRVO) announced on Monday that its drug continued to slow disease progression in a type of dementia during the extension phase of its mid-stage trial.

Dementia with Lewy Bodies (DLB) patients treated with Neflamapimod showed a 54% risk reduction in clinically significant worsening compared to control at week 32 of treatment based on Clinical Dementia Rating Sum of Boxes, a standard measure of clinical progression in dementia trials, the company said.

The risk reduction improved to 64% among patients with minimal Alzheimer’s disease co-pathology, it added.

DLB is a type of dementia characterized by the presence of Lewy bodies, which are clumps of protein, in the brain. It is the second most common form of neurodegenerative dementia, following Alzheimer's disease.

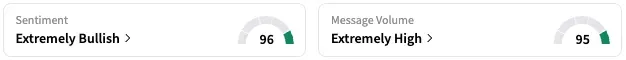

On Stocktwits, retail sentiment around CervoMed trended in the ‘extremely bullish’ territory, while message volume is at ‘extremely high’ levels.

A Stocktwits user indicated they are awaiting analysts’ takes on the news.

Another user praised the result and highlighted that they have loaded up on the stock.

Lawrence S. Honig, Professor of Neurology at Columbia University Irving Medical Center, stated that this level of effect, if confirmed in a Phase 3 pivotal trial, would be an important advance in the unmet treatment needs of patients with DLB, the second most common dementia.

The company is now looking forward to initiating late-stage trials and is preparing to meet with the U.S. Food and Drug Administration in the fourth quarter to align on the trial design.

The firm also said that at week 32 of the extension phase, there was a statistically significant reduction from baseline in plasma levels of glial fibrillary acidic protein (GFAP).

Plasma levels of glial fibrillary acidic protein (GFAP) are generally low in healthy individuals but can increase with certain neurological conditions.

No new safety signals were identified during the extension phase of the trial, it added.

CRVO stock is up by over 300% this year but down by 33% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)