Advertisement|Remove ads.

Charles Gillespie Raises Ownership In Gambling.com – ‘Buying Back Stocks At Current Levels Is Unbelievably Attractive’

- Charles Gillespie increased his ownership in Gambling.com from below 10% to over 11%.

- Gillespie told Stocktwits that share buybacks present the best use of cash right now.

- He said the company had made progress in diversifying its revenue away from Google.

Charles Gillespie, CEO and co-founder of Gambling.com Group (GAMB), has increased his stake in the sports betting firm by acquiring 351,000 additional shares, pushing his ownership from below 10% to over 11%.

In a post on the X platform, Gillespie described the purchase as a chance to secure shares he believes are undervalued, citing a disconnect between current market pricing and the company's perceived value.

Buybacks At Current Levels ‘Unbelievably Attractive’

Earlier, during an interview with Stocktwits’ Michele Steele, Gillespie stated that “buying back stocks at current levels is unbelievably attractive”. He further emphasized that, among debt repayment, share repurchases, and mergers & acquisitions, share buybacks are the best use of cash right now.

Gillespie said the company’s Sports Data Services business's growth boosted its third-quarter (Q3) earnings and added that the company has made progress in diversifying revenue away from Google. He expects 35% of group revenue in the fourth quarter (Q4) directly from Google, down significantly from two years ago.

“We are still making a ton of money, we had $13 million in EBITDA, nearly $10 million in free cash flow, that's overwhelmingly driven by continued strength in the marketing business,” said Gillespie.

By publicly affirming his confidence and acquiring additional shares, Gillespie underscores a strong belief in the company’s long-term prospects.

Management Moves

According to Gillespie, the acquisition reflects a broader trend among senior executives who are reportedly buying into the firm. Gillespie also indicated that he plans to provide a detailed update on the total number of shares recently acquired by management, signaling confidence in the company’s outlook.

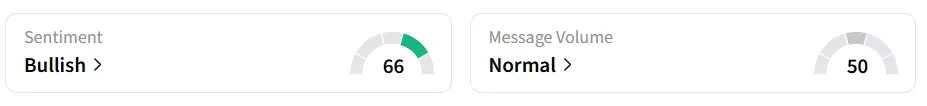

Gambling’s stock traded over 3% higher on Wednesday morning. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory. Message volume changed to ‘normal’ from ‘high’ levels in 24 hours.

GAMB stock has lost over 62% year to date.

Also See: Datavault AI Taps WBC Partnership To Monetize Global Boxing Fandom

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)