Advertisement|Remove ads.

Charter Buzzes With Bullish Chatter Despite Subscriber Drop And Mixed Q2 Results: Here’s Why

Charter Communications Inc. (CHTR) garnered a 500% surge in retail chatter in 24 hours, despite a modest revenue growth in the second quarter (Q2) and a decline in its internet customer base, as traders reiterated their faith in the company’s growth potential and cash flow.

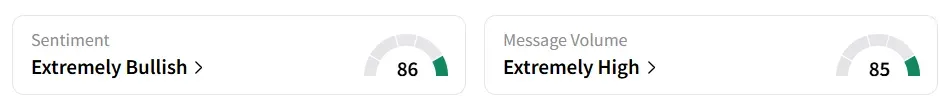

Retail sentiment around the stock improved to ‘extremely bullish’ (86/100) from ‘bullish’ the previous day, and message volume shifted to ‘extremely high’ (85/100) from ‘high’ in the last 24 hours.

Retail sentiment reached a three-month high, while message volume was the highest year-to-date. Charter Communications stock traded over 9% lower on Friday mid-morning.

Stocktwits users reported confidence in the company’s growth plan.

Another user said they have added more of the stock.

The company’s Q2 revenue increased 0.6% year-on-year (YoY) to $13.8 billion, slightly beating the analysts’ consensus estimate of $13.7 billion, as per Fiscal AI data.

Mobile and residential internet services drove the revenue growth, but the company’s internet customer base declined by 117,000 in Q2.

In contrast, mobile services continued to gain traction, with 500,000 new mobile lines added, raising the mobile total to 10.9 million lines.

Earnings per share (EPS) of $9.18 missed the consensus estimate of $9.7.

Adjusted EBITDA came in at $5.7 billion, a 0.5% increase YoY. Free cash flow dropped to $1.0 billion from $1.3 billion in the prior year, primarily due to changes in mobile device working capital and the timing of cash taxes and interest payments.

Operating cash flow totaled $3.6 billion. Charter repurchased 4.5 million shares of its Class A common stock and units of Charter Holdings, amounting to $1.7 billion in buybacks during the quarter.

Charter Communications stock has lost over 7% year-to-date and gained 0.3% in the past 12 months.

Also See: This Stock Goes Viral On Stocktwits After Nvidia Integration, Sees Retail Sentiment Hit 4-Year High

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)