Advertisement|Remove ads.

Chevron Rated 'Outperform' By Evercore Ahead Of Q2 Results, But Retail Investors Hit The Brakes

Chevron Corp (CVX) received an ‘Outperform’ rating from Evercore ISI as it resumed coverage on the oil producer heading into its quarterly earnings on Friday. Retail investors and Wall Street are eyeing the impact of the company’s Hess acquisition and lower crude prices on its earnings.

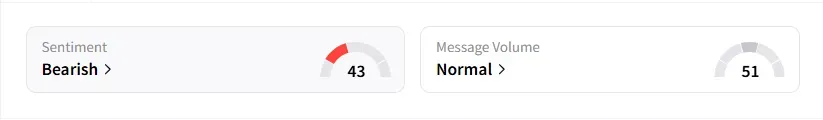

The retail user message count on the company rose 11% over the last seven days on Stocktwits. Retail sentiment on Chevron’s stock dropped to ‘bearish’ from ‘neutral’ territory compared to a day ago, with chatter at ‘normal’ levels, according to Stocktwits data.

Evercore resumed coverage with $180 price target, according to TheFly. The brokerage said the Hess acquisition should boost Chevron's upstream trajectory, particularly in Guyana, while maintaining disciplined capital spending, which will position Chevron for strong free cash flow growth.

In July, Chevron closed the $53 billion deal with Hess after winning a legal battle against Exxon Mobil (XOM) and giving it access to the Stabroek Block, which holds at least 11 billion barrels of oil equivalent.

On Wednesday, media reports said that Chevron has been granted a restricted U.S. license to operate in sanctioned Venezuela and that the authorization, issued privately to the U.S. oil producer, opens a new window for its oil business in Venezuela.

This comes only two months after a deadline previously set by Washington for joint-venture partners of state company PDVSA to wind down transactions, including oil exports.

Chevron is expected to post second-quarter revenue of $45.05 billion and earnings per share (EPS) of $1.73, according to data compiled by Fiscal AI.

Shares of Chevron were down nearly 1% in premarket trading on Thursday. The stock has jumped 6% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)