Advertisement|Remove ads.

Retail Investors See Cisco’s $15B Buyback Driving Double-Digit Gains Over The Next 6 Months

Cisco Systems' (CSCO) new $15 billion stock buyback program has sparked bullish sentiment among retail investors, with many expecting the move to drive shares higher.

With $17 billion now earmarked for repurchases, investors remain optimistic that Cisco’s capital allocation strategy will continue to provide a tailwind for its stock.

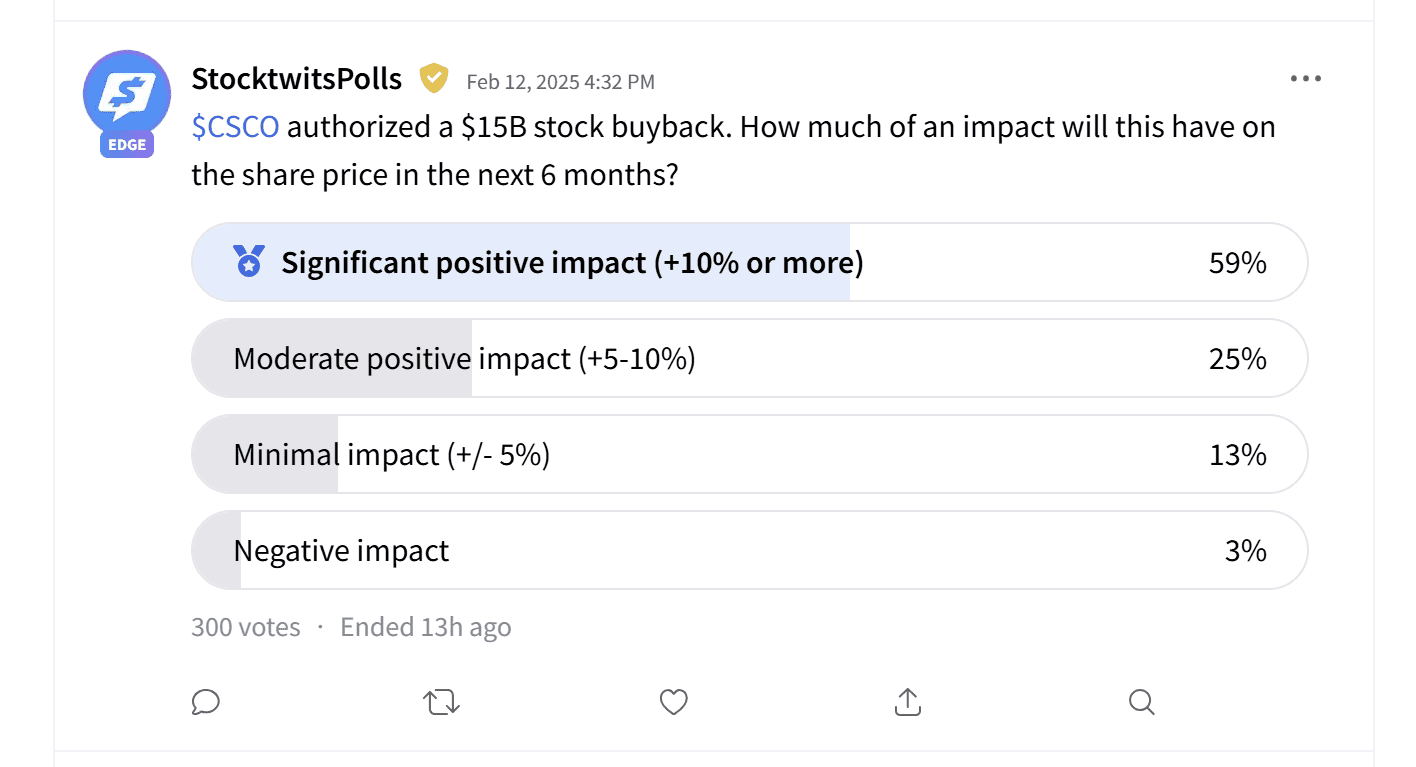

A recent Stocktwits poll found that 59% of respondents anticipate at least a 10% gain over the next six months, while 25% foresee a more moderate increase of 5% to 10%.

Only 13% of investors on the platform expect a minimal impact, and just 3% believe the buyback will negatively affect the stock.

Investor enthusiasm is rooted in the expectation that large-scale buybacks reduce the share supply, boost earnings per share (EPS), and support stock valuations.

For Cisco, a mature tech company with a steady revenue stream, capital return policies have historically been well received. The company has already repurchased over $7.5 billion in stock over the past year.

Cisco's recent earnings report exceeded analyst expectations, showcasing a 9% year-over-year revenue increase to $14 billion, while EPS came in at $0.94, surpassing analyst expectations.

In addition to the buyback, Cisco raised its quarterly dividend by 3%, reinforcing its commitment to returning capital to shareholders.

Cisco’s shares hit an all-time high of $66.50 on Feb. 13 following the earnings announcement.

The stock has climbed nearly 9% year-to-date and is up more than 33% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Retail Traders Are Buying The Crypto Dip — But Not Bitcoin

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_automotive_jpg_e356c1abe5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_DOJ_OG_jpg_112facb96e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Bio_N_Tech_m_RNA_based_vaccine_manufacturing_site_in_Kigali_2_4fd2e38342.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ackman_April_resized_jpg_c56afab1eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)