Advertisement|Remove ads.

Citi Reportedly Transfers $81 Trillion To Client Account Erroneously, Mistake Rectified Within Hours – Stock, Retail Stay Unswayed

Citigroup Inc (C) stock drew unwanted attention on Friday after a report said the bank incorrectly credited $81 trillion into a client account instead of transferring just $280.

According to a Financial Times report, the incident occurred in April last year.

The report elaborated that the transfer was missed by both a payments employee and a second official who was tasked with checking the transaction before approving it to be processed the following business day.

FT said in its report that a third employee identified the problem 90 minutes after it was posted. The report cited “an internal account of the event” and two people familiar with the event saying that the payment was reversed hours later.

Meanwhile, Citi said, “Detective controls promptly identified the inputting error between two Citi ledger accounts and we reversed the entry.” The bank added that the mechanisms “would have also stopped any funds leaving the bank.”

“While there was no impact to the bank or our client, the episode underscores our continued efforts to continue eliminating manual processes and automating controls,” the bank said, according to the report.

Reports indicate that the latest operational hiccup could hurt the bank’s efforts to convince regulators that it has fixed its operational problems.

Five years earlier, the lender reportedly sent $900 million by mistake to creditors entwined in a battle over the debt of cosmetics group Revlon.

In July 2024, Citi was fined $136 million for failing to fix data management issues. Before that, federal regulators had fined the bank $400 million for long-running internal issues.

Despite the concerning report, Citi stock traded just 0.46% lower on Friday morning as investors appeared to have shrugged off the event.

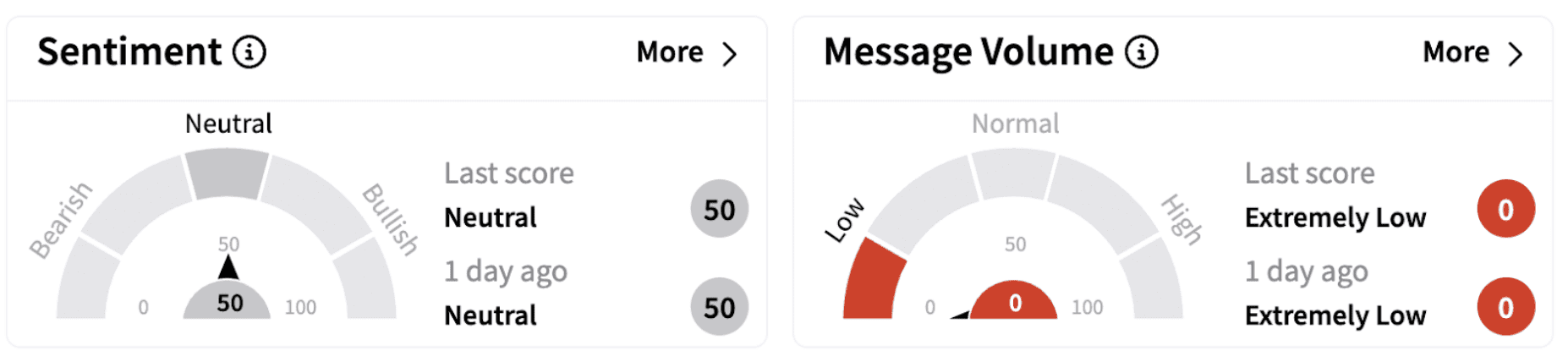

Retail sentiment surrounding the stock remained ‘neutral’ on Stocktwits.

Some users did express concerns following the report.

Citi stock has gained over 12% in 2025 and 42% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)