Advertisement|Remove ads.

UAA Shares Climb On Fairfax Financial Stake Disclosure

- This amounts to about 22% stake in the sportswear company for Fairfax Financial.

- Earlier, UBS analyst Jay Sole said that he believes in the company after the firm's annual global athletic wear survey reinforced that Under Armour is still one of the world's best-known and -liked athletic wear brands.

- Shares of Under Armour went up more than 4% in Monday’s after market trading.

Shares of Under Armour Inc. (UAA) went up more than 4% in Monday’s after hour trading after Fairfax Financial Holdings disclosed a considerable stake in the company.

Fairfax Financial disclosed that it holds 41.9 million Class A Under Armour shares as of 30 Dec. 2025, according to an SEC filing. This amounts to about 22% stake in the sportswear company.

The disclosure comes even as the company has been working to revive its business. Most recently, the company parted ways with NBA star Stephen Curry, ending a partnership of more than a decade.

Street Calls

Earlier, UBS analyst Jay Sole said that he believes in the company after the firm's annual global athletic wear survey reinforced that Under Armour is still one of the world's best-known and -liked athletic wear brands.

The analyst said that it believes Investors are "materially" undervaluing the Under Armour brand name, as per TheFly. UBS also added that it believes Under Armour is a "turnaround stock" that will achieve a 25% annual earnings growth over the next five years.

This growth will positively surprise the market, the firm said, adding that it believes improving North America sales growth will boost the stock's valuation. UBS maintained its ‘Buy’ rating on UAA shares with a price target of $8.

Under Armour said earlier in 2025 that it expects a GAAP-adjusted operating loss of $56 million to $71 million in fiscal year 2026 versus its previous expectation of operating income of $19 million to $34 million. The company also forecasted an adjusted operating income of $95 million to $110 million, compared to the prior range of $90 million to $105 million.

How Did Stocktwits Users React?

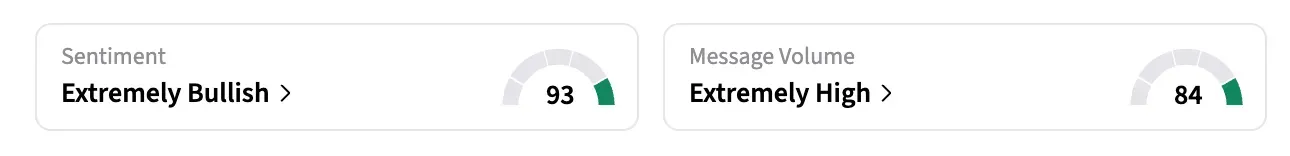

On Stocktwits, retail sentiment around UAA stock remained in the ‘extremely bullish’ territory over the past 24 hours amid ‘extremely high’ message volume.

One user noted Fairfax Financial’s increased stake could be a strong indication that something really good is brewing for the company.

Shares of UAA are down 36% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)