Advertisement|Remove ads.

Core Scientific Stock Plummets As February Bitcoin Mining Output Declines More Than Peers RIOT, MARA – Retail Remains Bullish

Bitcoin miner Core Scientific (CORZ) shares plummeted 16% at market open on Thursday even as the apex crypto topped $91,000, after the company reported mining productivity and revenue declines for February.

If the losses sustain until market closing, Thursday’s pullback could mark Core Scientific’s worst single-day drop since Jan. 27, when a broader sell-off in crypto-related stocks was triggered by risk aversion amid a model update from Chinese AI firm DeepSeek.

Retail buzz surged around the stock, putting it among the 10 top trending tickers on Stocktwits.

The company mined 215 Bitcoin (BTC) during the month, down 16% from the 256 BTC it generated in January, bringing its total production for the year to 471 BTC.

The shorter month contributed to lower daily mining rewards, a trend seen across the industry, including competitors Marathon Digital and Riot Platforms.

Marathon, however, reported an increase in Bitcoin production per unit of mining power, while Riot saw only a slight decline of 1%.

Core Scientific’s output fell more sharply, with the number of self-mined Bitcoin per day dropping to 7.7 from 8.3 in January.

At the end of February, Core Scientific operated approximately 166,000 Bitcoin miners across its data centers, supporting both its self-mining and hosting businesses.

The company’s total energized hash rate stood at 19.4 exahashes per second (EH/s).

Cantor Fitzgerald lowered its price target for the stock to $20 from $21 but maintained an ‘Overweight’ rating.

The brokerage attributed the decline to a marginally lower energized hash rate at a time when the overall Bitcoin network hash rate – representing total computing power – continued to rise.

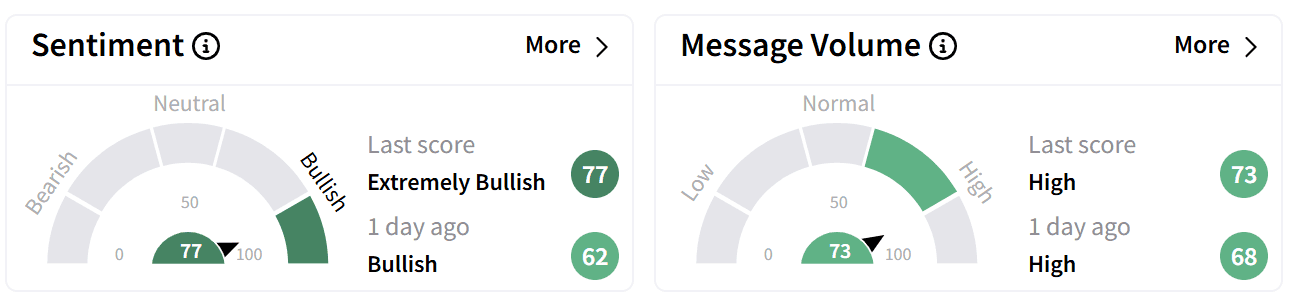

Despite the sell-off, retail sentiment around Core Scientific’s stock on Stocktwits remained in the ‘extremely bullish’ zone accompanied by ‘high’ levels of chatter.

One user suggested Wall Street was orchestrating a coordinated effort to drive the stock price down.

Others viewed the dip as a buying opportunity.

Core Scientific shares have more than doubled over the past year, outperforming Bitcoin’s 37% gain. However, the stock is down more than 30% since the start of 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246877055_jpg_1283ae3088.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nintendo_switch_2_jpg_bccd766d3b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245602336_jpg_dcf0764466.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_861ba86dd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)