Advertisement|Remove ads.

MongoDB Stock Sinks Pre-Market As Weak Guidance Spawns Downgrade, Price Target Cuts – But Retail Isn’t Worried

MongoDB (MDB) shares tumbled as much as 19% in pre-market trade on Thursday after issuing underwhelming guidance for fiscal 2026, triggering a downgrade from Wells Fargo and a wave of price target cuts across Wall Street.

The database software company reported fourth-quarter (Q4) earnings per share (EPS) of $1.28, nearly doubling analysts’ expectations of $0.66.

Revenue came in at $548.4 million, exceeding estimates of $519.84 million.

Despite the strong results, Wall Street seems rattled by MongoDB’s outlook.

The company projected fiscal 2026 revenue between $2.24 billion and $2.28 billion, falling short of the consensus estimate of $2.32 billion.

Earnings guidance is forecast between $2.44 and $2.62, well below Wall Street’s estimate of $3.39.

Wells Fargo downgraded the stock to ‘Equal Weight’ from ‘Overweight’ and slashed its price target by more than $100 to $225 from $365.

The brokerage noted that MongoDB’s guidance and slowing multi-year deals suggest a challenging fiscal 2026.

Wells Fargo views the upcoming year as a “transition period” for the company, warning that revenue growth will “significantly decelerate” and limit the stock’s upside.

It added that MongoDB is still in the early stages of monetization, with Atlas starting to see further stabilization in its note to investors.

Atlas revenue contributed to 68% of MongoDB's topline and climbed 32.6% year-over-year, outpacing overall company growth.

Other major firms, including Barclays, Bank of America, Morgan Stanley, and Piper Sandler, maintained their ‘Buy’-equivalent ratings but reduced their price targets, citing the weak guidance, according to TheFly.

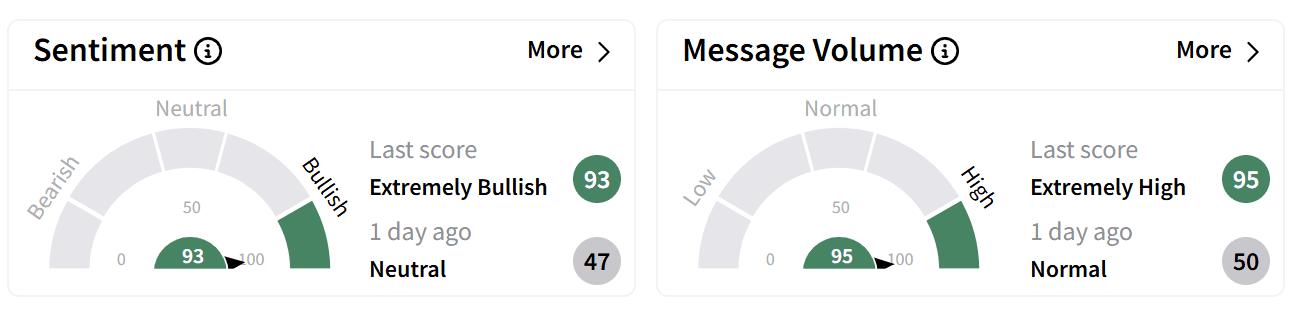

On Stocktwits, retail sentiment around MongoDB’s stock surged to ‘extremely bullish’ from ‘neutral’ a day ago, despite Wall Street’s pessimism.

Retail chatter jumped to year highs, rising to ‘extremely high’ levels.

Some users questioned why MongoDB consistently issues conservative guidance even though its earnings often align with estimates.

One user speculated that the stock may struggle to recover if the company continues to report negative profit margins and weak guidance each quarter.

MongoDB shares have lost nearly 40% over the past year but remain up 12% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)