Advertisement|Remove ads.

Costco Q4 Earnings Preview: Most Retail Traders Predict Profit Beat, Investors Eye Trump Tariff Impact

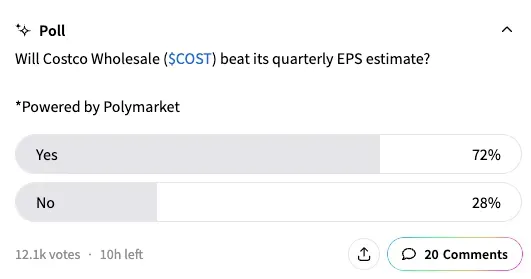

Nearly three-quarters of approximately 12,000 retail investors on Stocktwits believe that Costco Wholesale, among the largest U.S. retail chains, will beat earnings per share (EPS) estimates for the last quarter, according to a Stocktwits-Polymarket poll.

The company will report its fiscal fourth-quarter and fiscal 2025 results after the markets close on Thursday.

"Costco's value proposition is holding strong in a volatile retail landscape," a user commented on the poll, reminding how the company "crushed" EPS estimates in Q3. "If Q4 follows suit, expect continued upside pressure."

The bottom-line figure is significant for investors, who are looking for signs of how U.S. trade tariffs are impacting not only Costco but also the broader retail sector.

To be sure, Costco has another lever apart from raising product prices, as some of the competing retail chains have done.

The company raised the Costco membership fee in September last year, its first increase since 2017, and increased the perks for its executive members in July.

Cotsco is also reorganizing its imports to mitigate the impact of tariffs and has reportedly requested that Chinese suppliers reduce their prices.

According to analyst estimates from Koyfin, Costco's quarterly adjusted EPS is expected to rise 6% to $4.49, the slowest pace of growth since the May quarter of 2023. Revenue is expected to rise to about $86 billion from about $79 billion in the year-ago period.

On Stocktwits, the retail sentiment for COST shifted to 'extremely bullish' from 'bullish' the previous day, even as the stock gained 0.3% in early premarket trading on Thursday.

Year-to-date, COST shares are up a mere 3.3%, underperforming the gains in the benchmark S&P 500 index.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_parazero_technologies_drone_representative_resized_f67140d5c3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_upwork_jpg_f9d5e591d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2248926041_jpg_87d77606e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rare_Earth_resized_jpg_e635892f59.webp)