Advertisement|Remove ads.

BTC Price Rebounds To $91,000 After $1 Billion Crypto Liquidation Wave

- More than $1 billion in leveraged crypto positions were liquidated over 24 hours, largely from long bets.

- U.S. Bitcoin and Ethereum ETFs recorded another day of net outflows.

- Crypto-linked equities, including those of Strategy and Coinbase, traded lower ahead of the market open.

Bitcoin’s (BTC) price recovered to $91,000 in early morning trade on Tuesday after hitting an intra-day low of around $89,400, triggering a broad sell-off that swept across the cryptocurrency market. More than $1 billion in leveraged bets were wiped out in the last 24 hours as volatility surged.

BTC’s price fell 4.6% in the last 24 hours and was the top trending ticker on Stocktwits. Retail sentiment around the apex cryptocurrency dipped to ‘extremely bearish’ from ‘bearish’ territory over the past day as chatter remained at ‘high’ levels.

Bitcoin is now down more than 2% since the start of 2025, according to Coinbase, just six weeks after the community celebrated its all-time high of over $126,000.

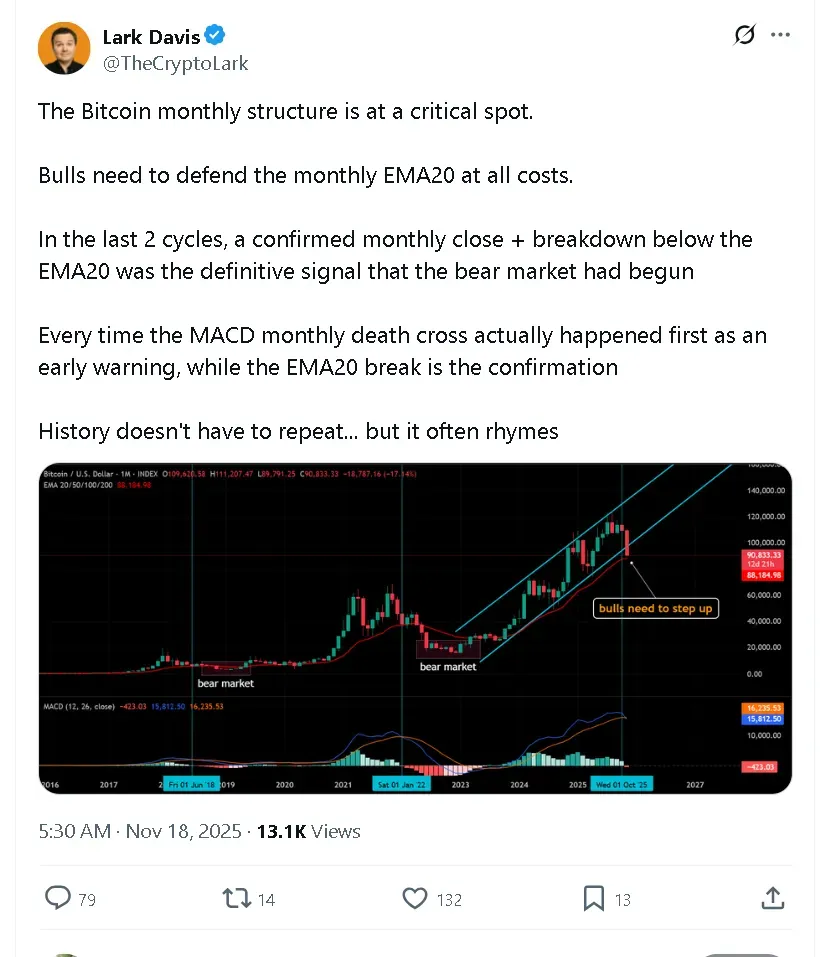

Australian Bitcoin investor Lark Davis stated that bulls need to keep Bitcoin’s price above the 20-month exponential moving average (EMA) because, in the past two market cycles, whenever Bitcoin closed a month below this metric, it signaled the start of a bear market. “History doesn't have to repeat... but it often rhymes,” he wrote on X.

Crypto Liquidations Cross $1 Billion

The overall cryptocurrency market fell 3.6% over the past 24 hours, reducing its market capitalization to $3.2 trillion. The sudden plunge led to more than $1 billion in liquidations over the past 24 hours, according to data from CoinGlass. Long positions accounted for $726 million of the wipeout, compared with $308 million from shorts.

More than half of that $1 billion was from bets on Bitcoin, totaling around $570 million. Ethereum (ETH) saw $183 million in liquidations, while Solana (SOL) and XRP (XRP) traders absorbed $47 million and $43 million in losses, respectively.

Cardano Leads Losses

The only cryptocurrency to see a bigger drop than Bitcoin among major tokens was Cardano (ADA). ADA’s price fell 5.3% in the last 24 hours. The crypto has also logged the heaviest losses among the top 10 cryptocurrencies by market capitalization in the last 30 days. On Stocktwits, retail sentiment around the altcoin trended in ‘bearish’ territory, and chatter was at ‘normal’ levels over the past day.

Ethereum’s price fell 4.3% in the last 24 hours, and retail sentiment around the leading altcoin was in ‘bearish’ territory, accompanied by ‘high’ levels of chatter over the past day. Solana’s price fell 3% and retail sentiment dropped to ‘extremely bearish’ from ‘bearish’ territory.

Meanwhile, XRP’s price dipped 3.6%, but retail sentiment around the altcoin remained in ‘bullish’ territory, with ‘high’ levels of chatter over the past day.

Meme token Dogecoin (DOGE) fell 3.3% in the last 24 hours, while Binance Coin (BNB) was down 1.7% followed by Tron (TRX), which fell 1.4%.

ETF Outflows Signal Another Pressure Point

Institutional capital continued to pull back on Monday. U.S. spot Bitcoin ETFs posted $255 million in net outflows, marking a fourth straight day of redemptions, according to data from SoSoValue. BlackRock’s IBIT recorded the largest single-day outflow at $146 million. Spot Ethereum ETFs saw $183 million exit the market. Meanwhile, U.S. spot Solana ETFs continued to trend in the green, posting an $8.26 million net inflow.

On the equities side, shares of Strategy (MSTR), the largest corporate holder of Bitcoin, edged 0.88% lower in pre-market trade. Meanwhile, shares of Ethereum-backed digital asset treasury (DAT) firm Bitmine Immersion Technologies (BMNR) dipped nearly 0.58%. Crypto-exchange Coinbase (COIN) was down 0.88%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)