Advertisement. Remove ads.

Salesforce's $1.9B Deal For Own Gets Thumbs Up From BofA Analyst: Retail Turns Bullish

Shares of Salesforce Inc. (CRM) gained over 1% early on Friday following the announcement of a $1.9 billion cash deal to buy Own, a provider of data protection and management solutions. This acquisition reportedly marks Salesforce’s most significant deal since its $27.7 billion purchase of Slack in 2021.

Salesforce said the deal comes amid a growing need to protect against growing incidents of data loss from system failures, human error, and cyberattacks.

“This proposed transaction underscores our commitment to providing secure, end-to-end solutions that protect our customers’ most valuable data and navigate the shifting landscape of data security and compliance,” said Steve Fisher, a Salesforce executive responsible for data products.

Bank of America analyst Brad Sills sees the acquisition as a strategic win for Salesforce. As Own is already an existing partner on Salesforce’s App Store, Sills expects the technology integration to Salesforce’s Data Cloud to be relatively smooth.

The analyst believes that adding Own’s data intrusion prevention tools will accelerate Salesforce’s development efforts in data security, a critical need as enterprises increasingly adopt AI-driven solutions.

Sills reiterated a ‘Buy’ rating and a $325 price target for the stock, emphasizing that this move could catalyze further data migration to Salesforce’s Data Cloud.

Own, previously known as OwnBackup, has reportedly attracted funding from heavyweights like Salesforce Ventures, BlackRock, and Tiger Global since its founding in 2015.

Salesforce’s acquisition of Own comes just days after the company also announced the purchase of Tenyx, an AI-powered voice agent developer, highlighting the company’s ongoing investment in expanding its AI and data security capabilities.

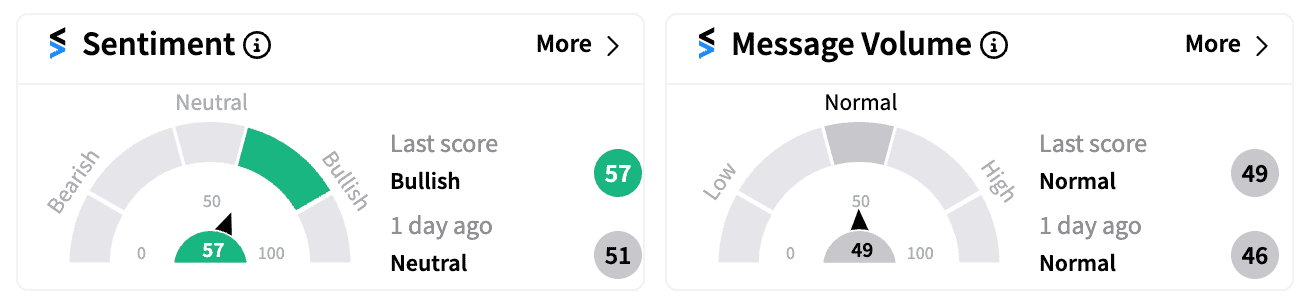

The retail investor community appears to support the acquisition. On Stocktwits, sentiment around Salesforce turned ‘bullish’ (57/100) from ‘neutral’.

The enthusiasm aligns with Salesforce’s recent momentum after delivering strong Q2 results and raising its annual profit outlook on the back of multi-cloud deals and growing AI demand.

Still, Salesforce stock remains down more than 3% this year, weighed down by concerns over high AI-related capital expenditures and slowing sales growth projections.

However, with $7.68 billion in cash on hand as of July 31, 2024, Salesforce remains well-positioned to continue pursuing growth through strategic acquisitions.

Read Next: Mobileye Stock Slumps As Intel Considers Stake Sale, Retail Sentiment Turns Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_hasbro_OG_jpg_4dd074e151.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_worldcoin_orb_OG_jpg_6c9401c649.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_OG_jpg_33767c6232.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233715487_jpg_d8c0f3abb7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elon_musk_jpg_80fa2e9cda.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231040292_jpg_098a089ec8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)