Advertisement|Remove ads.

DA Davidson Sees Little Innovation Ahead For Apple Amid AI Weakness, But Retail Goes Contrarian

DA Davidson has revised its rating on Apple Inc. (AAPL) from ‘Buy’ to ‘Neutral’, citing lackluster innovation and limited near-term potential in artificial intelligence.

The firm maintained its $250 price target but expressed doubts about Apple’s ability to lead the next wave of tech disruption. Apple’s product launch event, held on Tuesday, revealed the new iPhone 17, iPhone Air with the A19 Pro chip, iPhone 17 Pro, and iPhone 17 Pro Max.

DA Davidson said it was ‘uninspired’ by Apple’s recent product releases and said it failed to generate excitement or signal a shift toward AI integration. The firm also expressed skepticism over Apple’s readiness to take a central role in shaping the AI ecosystem.

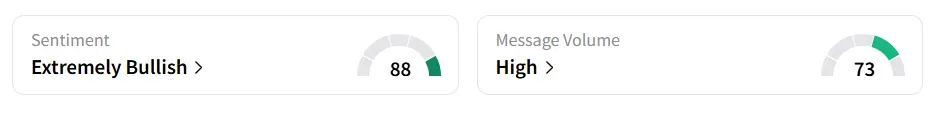

However, Apple stock inched 0.9% higher on Thursday morning, reversing a four-day decline. On Stocktwits, retail sentiment toward the stock remained in ‘extremely bullish’ territory amid ‘high’ message volume levels.

The stock saw a 98% increase in user message count over the last week.

A bullish Stocktwits user said they added more of the stock following the launch event drop.

Another user lauded the products launched.

The firm also questioned the potential of Apple’s next iPhone to drive a significant upgrade cycle. It suggested that unless Apple unveils a major hardware refresh or disruptive service, its near-term growth could remain subdued.

“Apple taking a significant role in the artificial intelligence ecosystem and the iPhone undergoing a major upgrade cycle are unlikely in the near term,” said DA Davidson.

The tech giant’s muted momentum in AI contrasts with the aggressive advancements of its peers. Apple stock has lost over 8% in 2025 and has gained over 2% in the last 12 months.

Also See: Why Did Micron Technology Stock Surge 8% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)