Advertisement|Remove ads.

Dallas Fed’s Lorie Logan Says Although Economy’s Strong, Meaningful Uncertainties Remain In Outlook

Dallas Federal Reserve President Lorie K. Logan said on Monday that although the economy is strong and stable, meaningful uncertainties remain in the outlook.

“Downside risks to the labor market have increased, balanced against diminished but still real upside risks to inflation. And many of these risks are complex to assess and measure,” Lorie said in her remarks at the Securities Industry and Financial Markets Association annual meeting.

The Dallas Fed President added that if the economy evolves as she currently expects, a strategy of gradually lowering the policy rate toward a more normal or neutral level can help manage the risks and achieve the Fed’s goals.

"However, any number of shocks could influence what that path to normal will look like, how fast policy should move and where rates should settle. In my view, the FOMC will need to remain nimble and willing to adjust if appropriate,” she said.

Logan also spoke about the Fed’s balance sheet and said that there will be occasional and modest rate pressures as the balance sheet shrinks. Such temporary rate pressures can be price signals that help market participants redistribute liquidity to the places where it’s needed most, Logan said.

“And from a policy perspective, I think it’s important to tolerate normal, modest, temporary pressures of this type so we can get to an efficient balance sheet size,” she noted.

A strong jobs report followed by robust retail sales data has tempered expectations of any aggressive rate cuts in the coming months. However, benchmark indices have been hitting new record highs, mainly driven by corporate earnings.

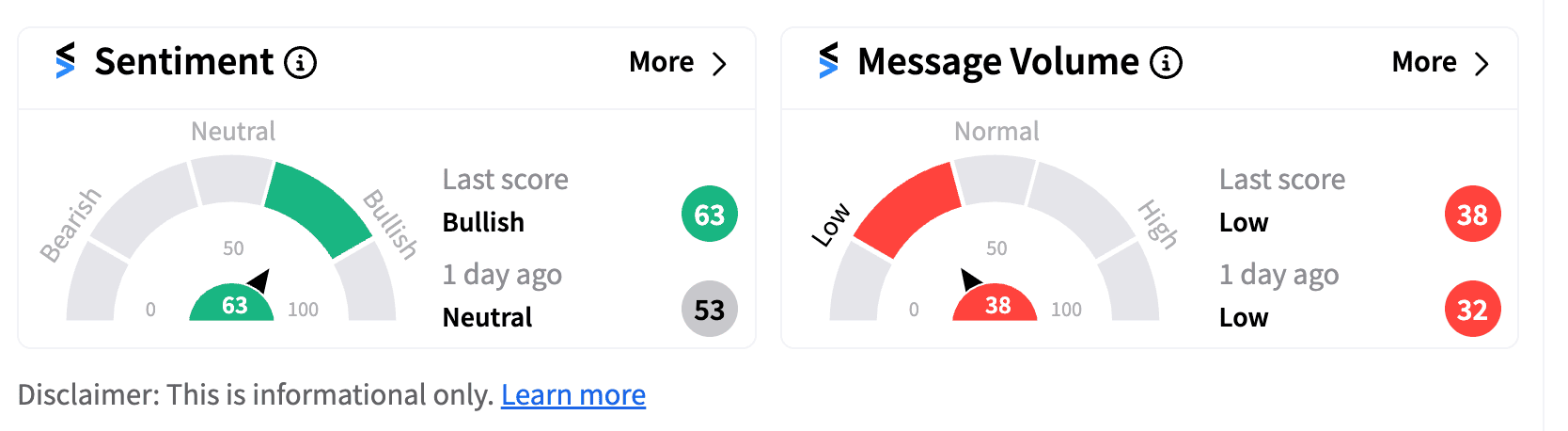

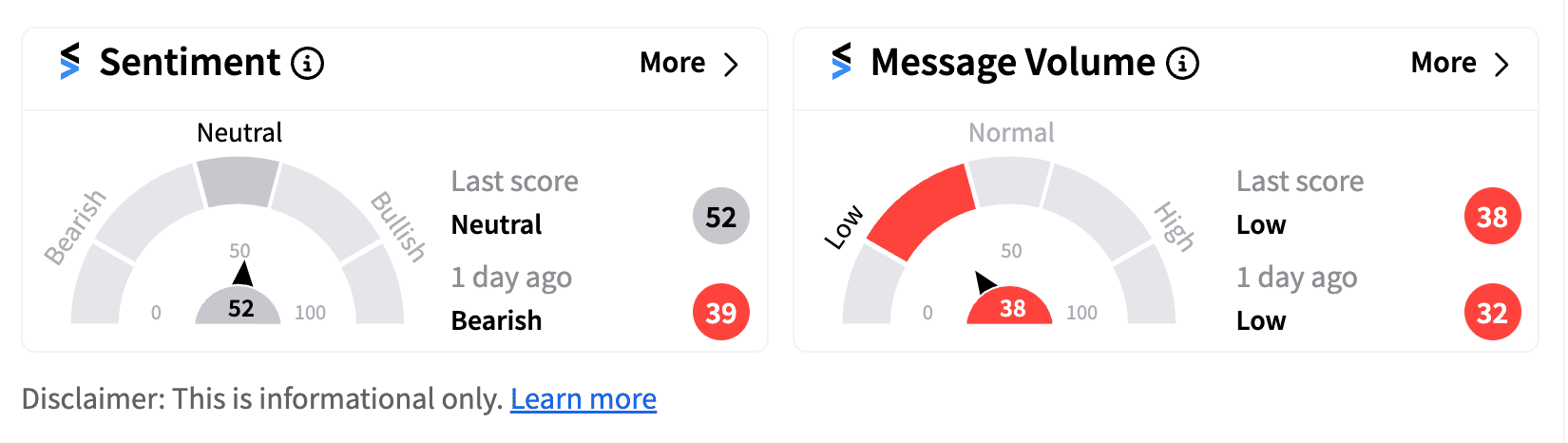

The SPDR S&P 500 ETF Trust ($SPY) was trading lower by 0.12% on Monday while the Invesco QQQ Trust, Series 1 ($QQQ) fell 0.25%. Retail sentiment on Stocktwits remained in the 'neutral' to 'bullish' territories for both the ETFs.

Also See: SLB Stock In Focus After Multiple Analysts Revise Price Target: Retail’s Extremely Bearish

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2156649816_jpg_bde9d5ac58.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)