Advertisement|Remove ads.

Deckers Stock Rallies On Strong Q1, Driven By International Sales Bump: Retail Turns Very Optimistic

Deckers Outdoor (DECK) shares rallied 12% in extended trading on Thursday, following the shoemaker's strong first-quarter fiscal 2026 results.

Revenue at Deckers, which sells Hoka running shoes and UGG boots, rose 17% to $964.5 million, beating analysts' estimate of $900.4 million. Net income rose to $0.93 per share, handily surpassing the expectation of $0.63.

The strong performance points to a nascent rebound after several disappointing quarters that raised concerns about the waning appeal of its Hoka line.

Deckers shares had lost half their value in the first half of 2025, the steepest drop among consumer stocks. In May, the company flagged $150 million in added costs from U.S. tariffs for FY26.

A standout item in Deckers' latest results was the company's international expansion. International sales soared 50%, inching closer to its domestic revenue, which fell 3%.

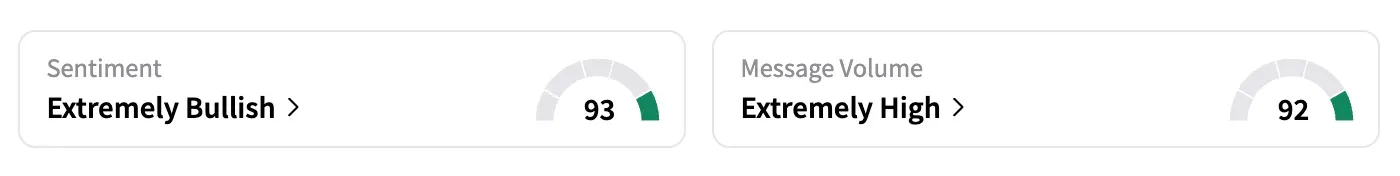

On Stocktwits, the retail sentiment shifted from 'bullish' to 'extremely bullish' (93/100).

"$DECK shorts getting a little too comfortable, this is at years lows, and the proof in international expansion is just what is needed to catch up to $NKE and prove it has a strong moat," a user said.

"HOKA and UGG outperformed our first quarter expectations," CEO Stefano Caroti said.

"Though uncertainty remains elevated in the global trade environment, our confidence in our brands has not changed, and the long-term opportunities ahead are significant."

Hoka sales climbed 20%, while Ugg sales rose 19%, above Wall Street's expectations on both counts. Wholesale revenue jumped 27% while direct-to-consumer sales advanced less than 1%.

For the current quarter, the company predicts revenue to be between $1.38 billion and $1.42 billion, with the midpoint aligning with current estimates. Earnings per share are anticipated to be $1.50 to $1.55, compared with Wall Street's $1.51.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2196133264_jpg_43c746e098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Diginex_resized_jpg_276540aa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231786819_jpg_17c63cbce2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205105208_jpg_1fbb750c7a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Draft_Kings_jpg_c77a08f48a.webp)