Advertisement|Remove ads.

Spirit Airlines Rejects New Merger Offer From Frontier: Retail’s Optimistic About A Deal

Spirit Airlines (SAVEQ) and Frontier Group Holdings Inc (ULCC) garnered retail attention on Wednesday after the former rejected Frontier's slightly modified buyout offer.

Spirit said that on Feb. 4, it received a new proposal from Frontier, essentially the same as its earlier offer of $400 million in debt and a 19% stake in Frontier.

However, the new offer did not require Spirit to complete its previously announced $350 million equity rights offering. But it needed a waiver of the Bankruptcy Court-approved $35 million termination fee.

“The new proposal did not address certain material risks and issues previously identified by the company, including that the new proposal would deliver less in value to the company's stakeholders than contemplated by the company's existing plan of reorganization,” Spirit said in a statement.

The airline company said it had submitted a counterproposal to Frontier, which was rejected.

Frontier first agreed to buy Spirit in 2022, but the deal did not take place after rival JetBlue made a better offer. A U.S. judge then blocked the deal with JetBlue following a challenge by the U.S. Department of Justice.

Spirit filed for bankruptcy protection in November after years of losses and the failed merger with JetBlue.

The airline had entered into a restructuring support agreement supported by most of its convertible bondholders on the terms of a comprehensive balance sheet restructuring.

A confirmation hearing about Spirit’s plan of reorganization is currently scheduled for Feb. 13.

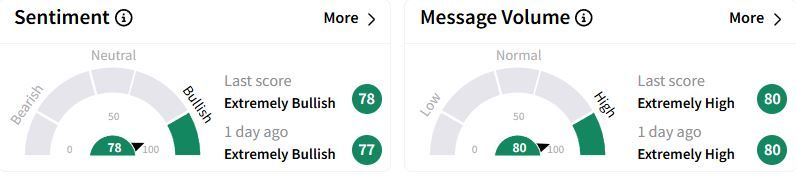

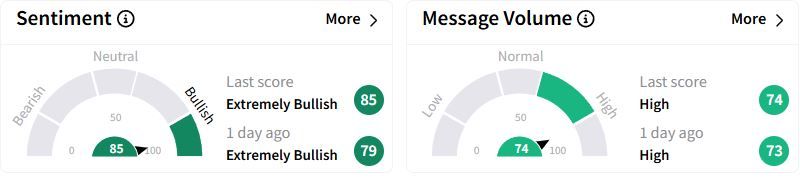

Retail sentiment on Stocktwits surrounding Frontier and Spirit trended in the ‘extremely bullish’ territory.

Retailers welcomed the talks, while some urged Spirit to go through with the deal.

Over the past year, Frontier stock has gained 23.5%, while Spirit Airlines stock has more than doubled this year.

Also See: Upstart Holdings Stock Soars Aftermarket After Surprise Q4 Profit: Retail’s Exuberant

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235337353_jpg_bdb561432a.webp)