Advertisement|Remove ads.

Delhivery Breakout Alert: SEBI RA Financial Independence Sees Further Upside Above ₹388

Delhivery stock broke out of a key resistance zone, climbing over 3.5% in Wednesday’s trading session, after the logistics company announced the expansion of its Chandigarh Gateway Hub.

Delhivery’s upgraded infrastructure adds 30% more storage capacity and advanced automation, including a 4,000-throughput/hour Hub Conveyor and a 12,000-throughput/hour Cross Belt Sorter, to streamline shipment processing and reduce turnaround time.

According to SEBI-registered analyst Financial Independence, the breakout was accompanied by a bullish candlestick confirming the strength of the move. A 3.7 million volume simple moving average (SMA) adds further conviction to the breakout.

The Relative Strength Index (RSI) currently stands at 70.58, which is close to its overbought zone, and while it reflects strong participation interest, buyers should look out for a brief consolidation phase, they added.

If Delhivery stock goes above the ₹385–₹388 range, supported by strong volumes, it could extend the rally towards the ₹405–₹420 target zone. On the downside, immediate support is seen around ₹360–₹365, the analysts said.

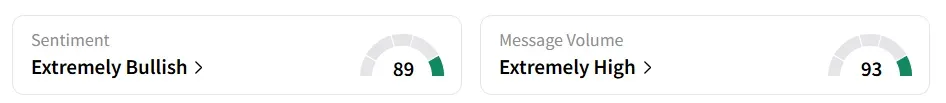

Retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a day earlier, amid ‘extremely high message volumes. Delhivery was among the ‘most active stocks’ on the platform.

At the time of writing, the stock was up 3.1% at ₹389, having gained 12.5% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)