Advertisement|Remove ads.

Boeing Stock Gains After Logging Highest Quarterly Deliveries Since 2023, Retail’s Bullish

Boeing's (BA) stock rose marginally on Tuesday after the company said it delivered 130 commercial airplanes in the first quarter, its highest in a three-month period since 2023.

The plane maker said it delivered 105 of its best-selling Max family aircraft and 13 787 family aircraft during the first quarter. It had delivered 83 commercial jets a year earlier.

European rival Airbus would reveal its first-quarter deliveries on Wednesday. According to a Reuters report, it delivered 136 planes in the first quarter.

The company delivered 41 planes in March, compared with 29 a year earlier. However, the deliveries were lower than the first two months of the year.

Boeing booked 192 gross orders in March, including 50 737 Max jets from Singapore-based firm BOC Aviation, 20 777x, and 20 787-10 series aircraft from Korean Air.

Wall Street monitors the company’s aircraft deliveries closely as Boeing receives most of its payments after its clients receive the planes.

The company has had a tumultuous 2024 when it was rocked by the twin blows of a crippling strike at its facilities as well as a production cap imposed on it after a door plug blew out of a 737 Max aircraft in January.

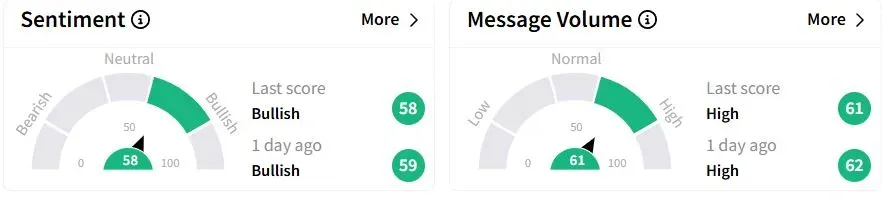

Retail sentiment on Stocktwits was in the ‘bullish’(58/100) territory, while retail chatter remained ‘high.’

One user suggested that countries may buy more of Boeing aircraft to reduce their trade deficit with the U.S.

Boeing stock has fallen 23.5% year-to-date (YTD).

Last week, the stock lost nearly 20%, tracking broader market declines after President Donald Trump imposed a universal 10% tariff on all imports and even higher duties on a host of countries.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222519332_jpg_15709268a8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_Power_jpg_08143c7fa0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_agilent_jpg_3c602c748e.webp)