Advertisement|Remove ads.

Estee Lauder’s Broader Bet Pays Off? Deutsche Bank Upgrades Stock On Diversifying Growth Beyond China

Deutsche Bank upgraded its rating on Estee Lauder to 'Buy' from 'Hold' on Monday, citing the beauty product giant's diversification beyond the Chinese market and travel retail channels.

According to the summary of the investor note on The Fly, the investment firm believes Estee Lauder is accelerating innovation across brands and price tiers while migrating decision-making geographically closer to where business operations occur.

Deutsche Bank raised the price target to $95 from $71, indicating a 26% increase from present levels. Estee Lauder shares are nearly flat year-to-date.

The cosmetics company has mostly completed its major investment cycle, in areas like supply chain and forecasting systems. With these enhancements in place, the company is now well-positioned to capitalize on future revenue growth, Deutsche Bank said.

The firm expects these completed investments to benefit the margin and profit recovery.

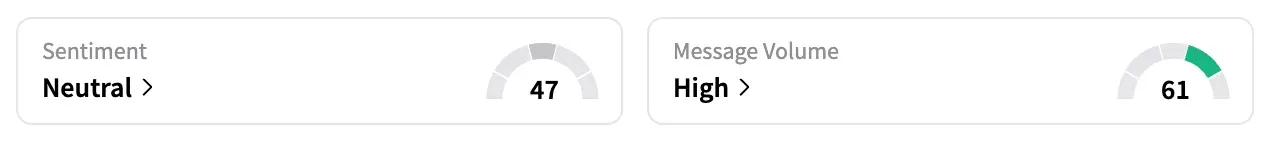

On Stocktwits, retail sentiment for EL was 'neutral' as of early Monday, compared to 'bullish' the previous day.

Last month, Estee Lauder forecasted its fiscal 2025 sales below Wall Street expectations, signaling continued weakness in its core American and Chinese markets.

It had said it would move forward with a previously announced restructuring plan, which includes cutting thousands of jobs, and steps to offset the effects of new U.S. import tariffs.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)