Advertisement|Remove ads.

DigitalOcean Stock Slips Ahead Of Q4 As Wall Street Predicts Earnings Drop, But Retail's Betting On A Bounce

DigitalOcean (DOCN) declined nearly 5.5% in Monday’s regular session ahead of the company’s fourth-quarter results as Wall Street expects a decline in earnings.

DigitalOcean is expected to post earnings per share of $0.34 during Q4, down from $0.44 a year ago. However, its revenue is estimated to grow to $200.57 million, surging from $180.87 million in the same period last year.

Data shows the cloud service provider has beaten earnings and revenue estimates in all the previous four quarters.

Although Wall Street is expecting a mixed Q4 for DigitalOcean, analysts at Goldman Sachs hiked their price target from $40 to $44 while maintaining a ‘Buy’ rating. This implies an upside of over 18% from Monday’s close.

Laying out the reasons behind its bullish outlook, the brokerage underscored that several existing and upcoming products showed off at DigitalOcean’s recent keynote event provide a structural tailwind to the company’s growth prospects.

Analysts at Oppenheimer believe that the launch of the Chinese large-language model, DeepSeek, is a positive for companies like DigitalOcean.

According to FinChat data, the average price target for the DigitalOcean stock is $41.92, which implies an upside of nearly 13% from Monday’s closing price.

Of the 15 brokerage recommendations, there are four ‘Buy’ and ‘Outperform’ ratings, six ‘Hold’ ratings, and one ‘Underperform’ rating.

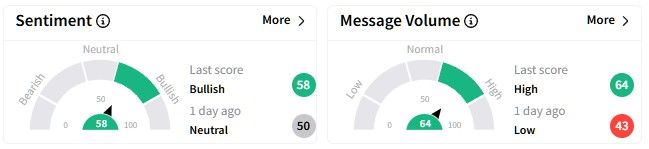

Retail sentiment on Stocktwits around the DigitalOcean stock turned ‘bullish’ (58/100) from ‘neutral’ (50/100) a day ago. The message volume rose to a ‘high’ level.

A user said that they “picked up” DigitalOcean shares and plan on riding out the earnings.

Another user was bullish on the stock, claiming that the share price will cross $60 after the earnings.

DigitalOcean’s stock has gained slightly over 9% year-to-date (YTD). It has increased by only 2.71% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_digitalpayments_resized_png_5e564e753b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208385583_jpg_9511ec9642.webp)