Advertisement|Remove ads.

Dreamfolks Extends Losing Streak: SEBI RA Akhilesh Jat Warns Of Further Downside

Dreamfolks Services, India’s largest airport service aggregator platform, extended its selloff for the second day, tumbling over 6% in Friday morning trade. This, even after the company clarified that it was not losing any clients.

On Thursday, reports claimed that select Indian banks and card services, including ICICI Bank, HDFC Bank, and Mastercard, were looking to bypass the aggregator and establish a direct partnership with airport lounge operators. Dreamfolks’ stock fell 10% in reaction.

SEBI-registered analyst Akhilesh Jat highlighted that the stock has been under persistent selling pressure, confirming a sustained downtrend.

From April 7, 2024, to May 23, 2025, Dreamfolks rallied nearly 45%, but Jat now described it as a classic Dead Cat Bounce, as prices have corrected more than 27% from recent highs. He sees ₹209, its all-time low, as a short-term support. However, the broader technical setup remains weak, with no meaningful upside visible soon.

Jat notes that a breakdown below ₹209 with consecutive closes could trigger further downside. Unless the stock reclaims and sustains above ₹310, it is advisable to avoid fresh positions, he cautioned, advising traders and investors to remain cautious.

Given that Dreamfolks has already erased about 75% of its value from its all-time high, further declines cannot be ruled out, Jat added.

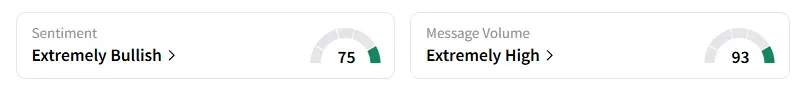

However, data on Stocktwits shows that retail sentiment turned ‘extremely bullish’ on this counter amid ‘extremely high’ message volumes.

Dreamfolks shares have fallen 38% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)