Advertisement|Remove ads.

EPack Prefab Stock Hits Record High After Q2 Profit Doubles

- Q2 profit more than doubled to ₹2,694 crore

- Stock made a weak debut on the primary exchanges earlier this month

- Move above current levels could open the door to targets around ₹260 in the next 2 - 3 weeks - analyst

Shares of EPack Prefab Technologies surged 20% to hit a fresh record on Thursday, after a stellar performance in the second quarter.

EPack Prefab stock also hit the upper circuit.

Q2 Profit Soars

The company reported a strong performance in Q2 FY26, with consolidated profit after tax more than doubling to ₹29.46 crore, compared to ₹14.42 crore last year. Revenue from operations surged 61.9% to ₹433.93 crore from ₹268.05 crore a year earlier.

Operating profit jumped 75% to ₹50 crore, while EBITDA margins improved to 11.52% from 10.65%, driven by higher sales volumes and improved operational efficiency.

The company’s order book stands at ₹65.56 crore for H1 FY26.

Momentum After Weak Listing

Earlier this month, shares of Epack Prefab Technologies made a weak debut on the primary exchanges, listing at a discount. On the BSE, the stock was listed at ₹186.10, nearly 9% below its issue price of ₹204, and on the NSE, it was listed at ₹ 183.85, a 10% discount from the issue price.

However, the stock has climbed steadily since then, closing at ₹203.44 in the previous session.

Analyst Recommendation: Strong Buy

The stock has broken out to new highs, supported by strong volume and momentum indicators. On the hourly chart, it is trading above both the 20-day exponential moving average (EMA) of ₹204 and the 50-day EMA of ₹214, confirming a short-term uptrend, noted SEBI-registered analyst Varunkumar Patel.

However, the relative strength index (RSI) near 78 suggests the stock is entering overbought territory, warranting some caution after the sharp rally. The 50-day EMA is expected to act as near-term support, while a move above current levels could open the door to targets around ₹260 in the next 2 - 3 weeks.

With a solid quarterly performance and leadership in the niche prefab/PEB segment, the company has gained investor attention. The overall technical consensus remains a “Strong Buy.”

What Is The Retail Mood On Stocktwits?

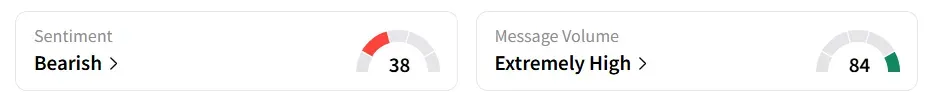

While the smashing intra-day stock movement drove retail chatter to ‘extremely high’ on Stocktwits, sentiment on the platform was ‘bearish’. It was ‘neutral’ earlier.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)