Advertisement|Remove ads.

Eagle Materials Stock Sees Worst Day In Nearly 5 Years After Q4 Miss, Retail Shrugs It Off

Eagle Materials (EXP) stock had its worst day since the COVID-19 pandemic after its fiscal fourth-quarter earnings missed Wall Street’s estimates.

According to FinChat data, the building materials supplier reported adjusted earnings of $2.08 per share, which missed estimates of $2.43 per share.

Its quarterly revenue fell to $470.2 million and missed Wall Street’s expectations of $479 million.

The company said adverse weather weighed in on its cement, concrete, and aggregates businesses in the first two months of the calendar year, while its costs also rose as it pulled forward the annual maintenance outage at its Texas Lehigh cement facility.

The company expects capital spending in fiscal 2026 to rise to a range of $475 million to $525 million.

“Despite the recent volatility in the capital markets due to changing trade and fiscal policies, we remain optimistic about our business,” CEO Michael Haack said.

While lower mortgage rates encouraged buyers to acquire new homes in February and March, Donald Trump’s tariff policies have dampened consumer sentiment.

According to a survey by the online housing brokerage Redfin, one out of four U.S. citizens said they were delaying large purchases in April.

“While high mortgage rates and housing affordability challenges continue to exert downward pressure on single-family housing starts, this pressure is mitigated somewhat by the clear need for new housing and overall pent-up buyer demand,” Haack said after acknowledging that the wallboard demand is in the same place as the past few years.

He was also confident about the long-term demand for cement due to “continued bipartisan support for infrastructure funding.”

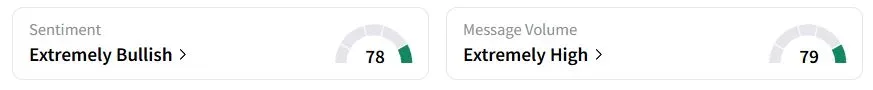

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (78/100) territory, while retail chatter was ‘extremely high.’

Eagle Materials stock has fallen 11.3% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)