Advertisement|Remove ads.

ELF Beauty Stock Tumbles Premarket After Forecast Freeze On China Tariff Fog: Retail Traders Sniff Opportunity

Shares of e.l.f. Beauty (ELF) fell more than 10% in premarket trading Thursday, after the cosmetics retailer posted quarterly results hit by U.S. tariffs and once again withheld an annual forecast.

Elf's net income dropped 30% to $33.3 million in the second quarter, partly due to increased tariffs on goods from China, which accounts for roughly 75% of its supply. Citing the evolving tariff negotiations between the U.S. and China, the company withheld its 2026 forecast.

Revenue and adjusted profit for the quarter, however, came higher than expectations. The company stated that its EBITDA margin is expected to be 20% in the first half of this year, down from 23% in the first half of 2024.

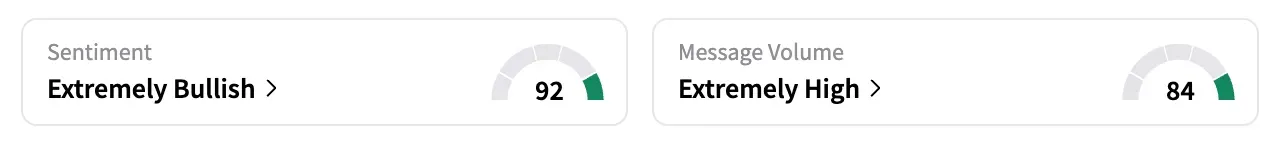

On Stocktwits, the retail sentiment for ELF shifted to 'extremely bullish' as of early Wednesday, from 'neutral' the previous day, after months of persisting weakness in the stock. ELF shares have declined 12% year-to-date, compared to the nearly 9% gains in the benchmark S&P 500 index (SPX).

One user said: "$ELF this is perfect cover for the gap below before heading back up. I'm happy to buy more if it stays at this level when the market opens."

Another user noted that the company has kept its product prices in check, compared to rivals selling high-end cosmetics, and has room to raise them further to support margins.

Elf Beauty, which had reduced its production in China from about 100% in 2019, stated that it has been optimizing its supply chain and adjusting its product and price mix to offset the tariff headwinds.

"We're operating in a very volatile macro environment, obviously a great deal of uncertainty on tariffs, so until we have greater resolution on what the tariff picture looks like, we didn't think it made sense to issue guidance," CEO Tarang Amin told CNBC in an interview.

Amin said the company is waiting for clarity on the final rates before implementing further changes.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)