Advertisement|Remove ads.

Zymeworks Stock Sees Surge In Retail Chatter After Royalty Pivot, Cancer Trial Win Sparks Target Price Hikes

- Zymeworks climbed in premarket trading after several firms raised price targets tied to its new royalty-driven strategy.

- Strong new Phase 3 Ziihera data boosted confidence in upcoming regulatory milestones.

- A $125 million buyback plan and expected milestone payments support operations well past 2028.

Zymeworks Inc. drew heightened retail chatter on Monday after a slew of analysts boosted their price targets, citing the company’s shift to a royalty-driven business model and fresh clinical momentum from its lead cancer program, Ziihera.

Analysts Lift Targets Following Royalty Strategy Reveal

The upgrades began last week, when H.C. Wainwright raised its price target to $32 from $26 and kept a ‘Buy’ rating, saying Ziihera plus chemotherapy, with or without Tevimbra, delivered “highly statistically significant” and clinically meaningful improvements in progression-free survival over trastuzumab plus chemotherapy. The firm lifted its approval probability for Ziihera in first-line HER2-positive gastroesophageal adenocarcinoma to 90% from 60%.

Leerink pushed its target to $40 from $37 and reiterated an ‘Outperform’ rating, saying Zymeworks’ move into a revenue-generating royalty aggregator should act as a catalyst once the full HERIZON GEA-01 dataset is presented. Leerink estimated that Zymeworks’ existing Ziihera royalties and milestone payments alone are worth about $29 per share, meaning the stock could be undervalued at its price of $24.02 as of Friday.

Wells Fargo raised its target to $25 from $17 with an ‘Equal Weight’ rating, citing value in the company’s partnership approach but noting it wants more clarity around the long-term royalty strategy beyond Ziihera. B. Riley lifted its target to $40 from $30, maintaining a ‘Buy’ rating and pointing to Zymeworks’ plan to optimize de-risked future cash flows through royalty aggregation and the potential partnering of ZW191 in 2026. The firm said the approach reduces binary risk while keeping internal R&D intact.

Stifel also raised its target to $40 from $30 and reiterated a ‘Buy’ rating, saying its updated model reflects partner Jazz Pharmaceuticals’ statistically significant and clinically meaningful topline results in the HERIZON-GEA-01 study, along with newly detailed milestone payments likely to be triggered by the trial’s success.

Royalty Pivot And Trial Results Strengthen Outlook

Last week, Zymeworks said it will evolve into a royalty-focused business model built around licensed products, including Ziihera and Pasritamig. The company said cash flows and milestone payments from these programs will be reinvested into both internal and acquired R&D candidates. Its board also approved a $125 million share repurchase plan.

The strategy update followed positive data from Ziihera combinations in first-line gastroesophageal adenocarcinoma, which showed statistically significant improvements in progression-free survival and, in one arm, overall survival. Partner Jazz plans to submit a supplemental BLA in the first half of 2026.

Zymeworks said it expects its current cash resources and upcoming milestones to fund operations beyond 2028.

Stocktwits Mood Leans Bearish

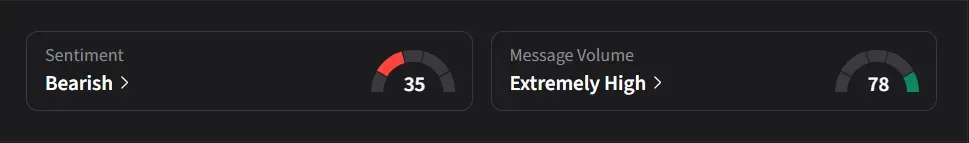

On Stocktwits, retail sentiment for Zymeworks was ‘bearish’ amid ‘extremely high’ message volume.

Zymeworks’ stock has risen 64% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_amazon_walmart_jpg_05c61e928f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2167490837_jpg_471b0d5535.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231498932_jpg_bdd44fc548.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AEHR_chip_maker_3698bf2343.jpg)