Advertisement|Remove ads.

Eli Lilly's Blockbuster Obesity Drugs Miss Sales Estimates Again, But Investors Cheer Q4 Earnings Beat

Eli Lilly shares rose more than 1% premarket Thursday, on track to hit levels last seen in late October, as the pharmaceutical giant posted stronger-than-expected earnings and revenue despite another sales miss for its obesity and diabetes drugs.

The company reported Q4 earnings per share (EPS) of $5.32, beating the $5.08 consensus estimate, while revenue came in at $13.53 billion, topping Wall Street’s $13.43 billion forecast.

Sales of its blockbuster GLP-1 drugs Zepbound and Mounjaro surged but came in slightly below expectations, weighed down by lower realized prices.

Mounjaro generated $3.53 billion in revenue, a 60% jump from the prior year but short of analysts’ $3.62 billion estimate. Zepbound posted $1.91 billion in sales, missing the $1.98 billion forecast.

This marks the second consecutive quarter where both drugs have fallen short of estimates, according to CNBC.

Older diabetes medicines outperformed expectations, helping offset the shortfall in Lilly’s newer treatments.

CEO David Ricks called 2024 a highly successful year, highlighting major clinical readouts for tirzepatide in treating chronic diseases tied to obesity, billions in manufacturing expansion, and the launch of Alzheimer’s drug Kisunla and dermatitis medication Ebglyss as key drivers of long-term growth.

“We enter 2025 with tremendous momentum and look forward to strong financial performance and several important Phase 3 readouts which, if positive, will further accelerate our long-term growth,” he added.

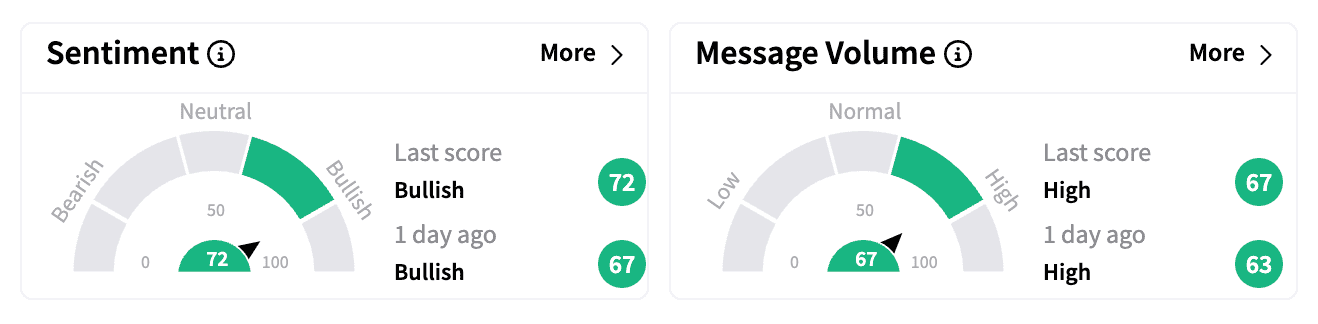

On Stocktwits, Eli Lilly was among the top 10 trending tickers ahead of Thursday’s opening, with sentiment turning more bullish.

Optimistic traders pointed to the earnings beat and expected continued strength, with one eyeing a move past $900.

Another said hedge funds and institutional investors would likely drive the actual move during market hours.

For 2025, Eli Lilly expects EPS between $22.50 and $24.00, compared to the $22.69 consensus estimate, and projects revenue between $58 billion and $61 billion, surpassing Wall Street’s $58.91 billion forecast.

The company is ramping production to meet soaring demand, estimating it will manufacture at least 1.6 times the number of incretin doses in the first half of 2025 compared to a year ago.

Lilly also announced plans to report late-stage data for its next-generation obesity drug retatrutide later this year, ahead of schedule.

As of Wednesday’s close, Eli Lilly’s stock was up nearly 8% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_merck_logo_resized_05f46cfc54.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)