Advertisement|Remove ads.

Eli Lilly’s Cancer Drug Demonstrates Better Effectiveness Than AbbVie’s In Late Stage Trial: Retail Believes In Holding The Stock

Eli Lilly and Company (LLY) on Tuesday said that its cancer drug Jaypirca was more effective than AbbVie’s drug Imbruvica in the treatment of patients with a type of blood cancer in a late-stage trial.

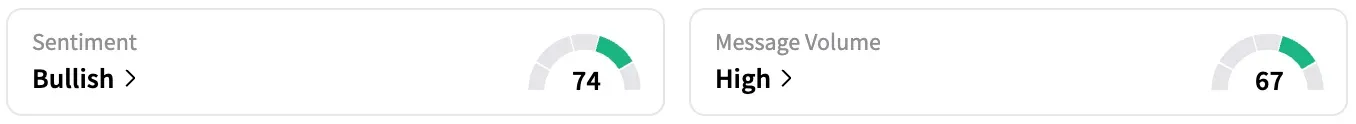

On Stocktwits, retail sentiment around Eli Lilly jumped from ‘neutral’ to ‘bullish’ over the past 24 hours while message volume rose from ‘normal’ to ‘high’ levels.

A Stocktwits user said that they are going to hold the stock.

Jaypirca was being tested in patients with chronic lymphocytic leukemia or small lymphocytic lymphoma who previously received no treatment or received previous treatment but not with a class of drugs called BTK inhibitors.

Jaypirca, approved by the U.S. Food and Drug Administration, is a BTK inhibitor.

Jaypirca had an overall response rate better than AbbVie’s Imbruvica in the study, meaning a higher percentage of patients treated with Jaypirca experienced their cancer shrink or disappear after treatment.

The company is now planning further testing to study Jaypirca’s superiority in the secondary endpoint of progression-free survival. Progression-free survival (PFS) is the length of time during and after treatment that a patient lives with the disease, but it does not get worse. While data on progression-free survival is not mature yet, it is trending in favor of Jaypirca, the company said.

"These data mark the second positive Phase 3 study in the program, as we continue to build evidence supporting the potential role of pirtobrutinib (Jaypirca) in treating people with CLL/SLL and hopefully enabling future regulatory approvals that allow physicians to use the medicine in various disease settings, whether treatment-naïve or BTK inhibitor-pretreated,” Jacob Van Naarden, executive vice president and president of Lilly Oncology, said.

Shares of LLY traded 5% lower on Tuesday afternoon at the time of writing, after its Danish rival Novo Nordisk (NVO) cut its full-year sales and profit guidance.

However, JPMorgan analyst Chris Schott on Tuesday said that they view Novo’s update as largely company-specific. The firm has an ‘Overweight’ rating on Lilly with a $1,100 price target.

LLY stock is down by 0.4% this year and by about 5% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)